American Technical Services, Inc.

ATS 2021™

USER MANUAL

FOR

ATS/COMP™

WORKERS’ COMPENSATION CLAIMS ADMINISTRATION MODULE

American Technical Services, Inc.

ATS 2021™

USER MANUAL

FOR

ATS/COMP™

WORKERS’ COMPENSATION CLAIMS ADMINISTRATION MODULE

ATS 2019™ User Manual for ATS/COMP™ Workers’ Compensation Claims Administration Module

First Edition October, 2021

© 2019 by American Technical Services, Inc. All rights reserved. No part of this publication may be reproduced or transmitted by any means without the prior written permission of the publisher:

American Technical Services, Inc.

2134 Palm Harbor Blvd, Suite A

Palm Harbor, FL 34683

Phone: (800) 654-7611

Fax: (727) 431-0150

Email: support@atsrmis.com

Web Site: https://www.atsrmis.com

Published and printed in the United States of America.

ATS 2019™ is a trademark of American Technical Services, Inc.

Windows™ is a trademark of Microsoft Corporation.

Word for Windows® is a registered trademark of Microsoft Corporation.

SAP® Crystal Reports® is a trademark of SAP SE, Inc.

Table of Contents

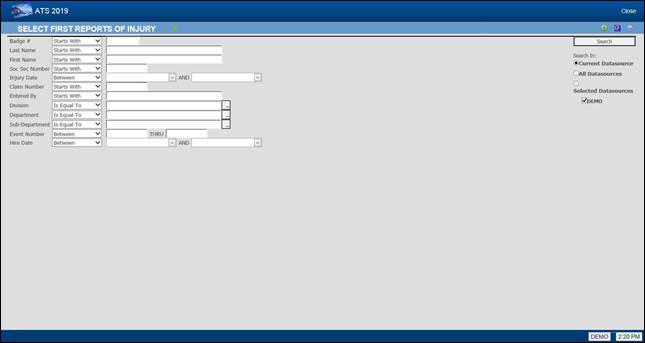

Searching for Existing Records

Adding an Employer’s Report of Injury or a Claim

4. Employer’s Report of Injury

Entering a New Employer’s Report

Batching the Employer’s Report Data

Marking Diary Entries as Reviewed

ISO Claim Search Export Utility

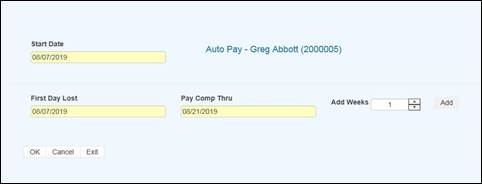

Using the Auto Setup of Compensation Button

Using the New Button to Schedule Payments

The Bundling and Unbundling Feature

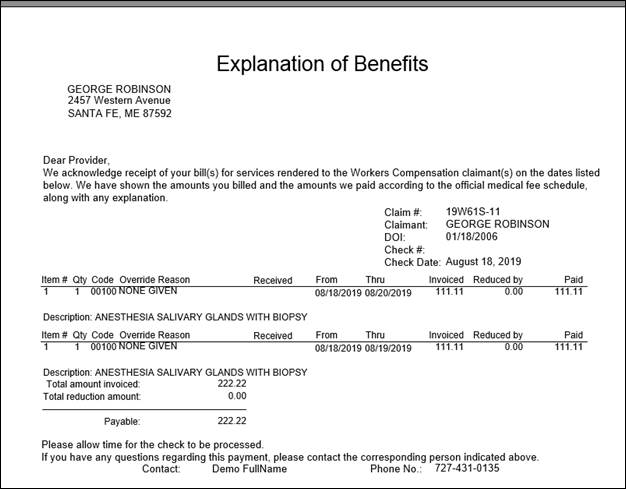

Printing the Explanation of Benefits

Marking Diary Entries as Reviewed

Entering the Selection Criteria

Entering the Output Specifications

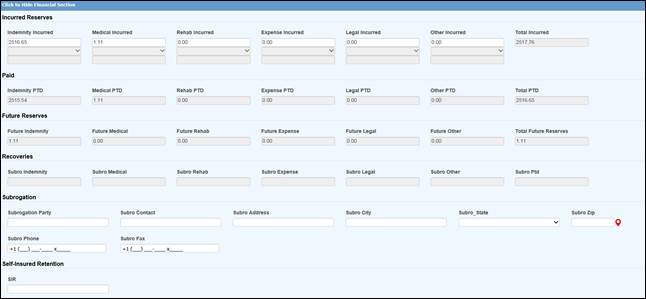

Reserves/Payment/Recovery Maintenance

SIC – Standard Industry Classification

NAIC – North American Industry Classification System

NCCI – National Council on Compensation Insurance

Table of Figures

Figure 1‑3: Sample Data Input Screen

Figure 1‑5: Claim Search Criteria

Figure 1‑6: Active Claims List

Figure 2‑1: Employee Data Input Page

Figure 2‑2: Employee Search Criteria

Figure 2‑3: Employee Search Result List

Figure 2‑4: Employee Also Known As List

Figure 2‑5: Employee Also Known As Dialog

Figure 2‑6: Employee Dependent List

Figure 2‑7: Employee Dependent Data Input

Figure 3‑1: Vendor Page - General Section

Figure 3‑2: Vendor Page - Finance Section

Figure 3‑3: Vendor Result List

Figure 4‑1: Employer’s Report Page - General Section

Figure 4‑2: Employer’s Report Page - Employer Section

Figure 4‑3: Employer’s Report Page - Detail Section

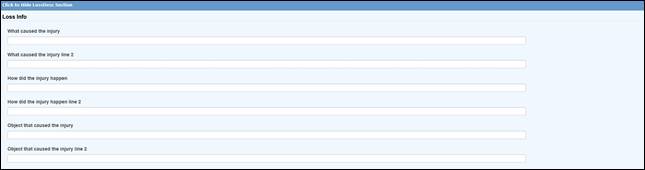

Figure 4‑4: Employer’s Report Page – Loss Description Section

Figure 4‑5: Employer’s Report Page – Loss Codes Section

Figure 4‑6: Employer’s Report Page – Medical Section

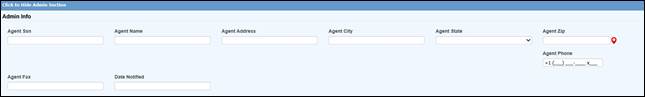

Figure 4‑7: Employer’s Report Page – Administrator Section

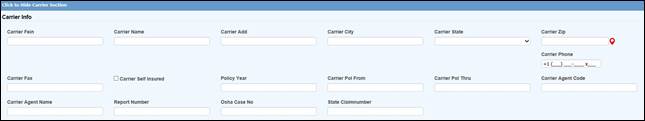

Figure 4‑8: Employer’s Report Page – Carrier Section

Figure 4‑9: Employer’s Report Page – Summary Section

Figure 4‑10: Employer’s Report Search Criteria

Figure 4‑11: Employer’s Report Result List

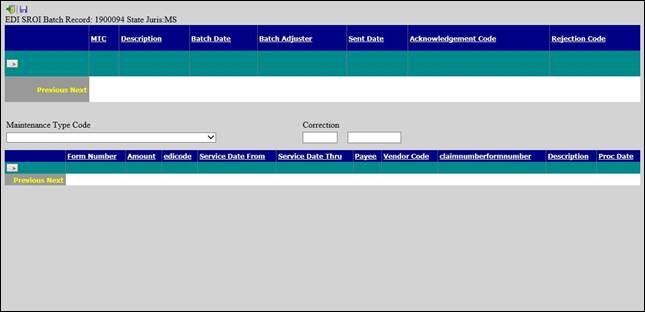

Figure 4‑12: Employer’s Report EDI Batch Dialog

Figure 5‑1: Claim Search Criteria

Figure 5‑2: State of Jurisdiction Dialog

Figure 5‑3: Claim Page – General Section (New)

Figure 5‑4: Claim Page – Details Section

Figure 5‑5: Claim Page – Reserves Section

Figure 5‑6: Reserves Change Reason Dialog

Figure 5‑7: Claim Page – Medical Section

Figure 5‑8: Claim Page – Legal Firms Section

Figure 5‑9: Claim Page – Litigation Section

Figure 5‑10: Claim Page – Rehab Section

Figure 5‑11: Claim Selection Screen

Figure 5‑12: Selected Claims List

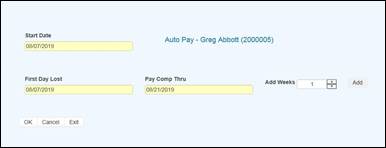

Figure 5‑14: Auto Pay Setup Screen

Figure 5‑15: Claim Diaries List

Figure 5‑17: ISO Export Utility

Figure 5‑19: Claim Notes Report Format

Figure 5‑20: Note Entry Dialog

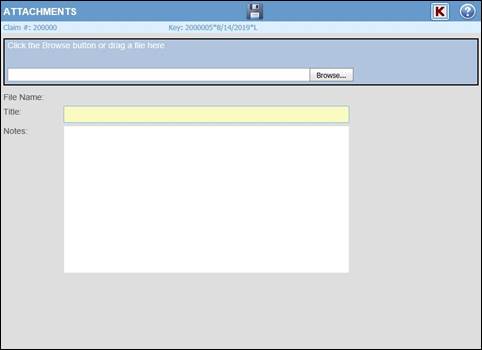

Figure 5‑21: Note Attachment Dialog

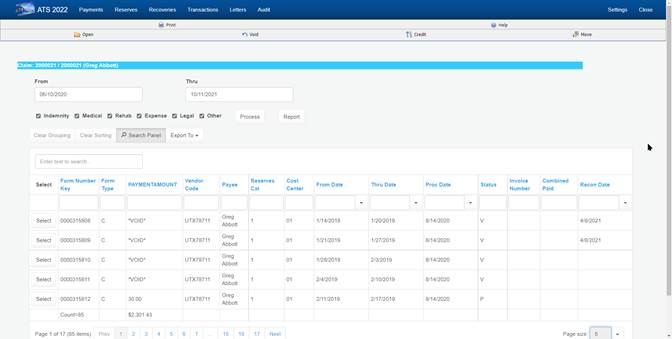

Figure 5‑22: Claim Payment History

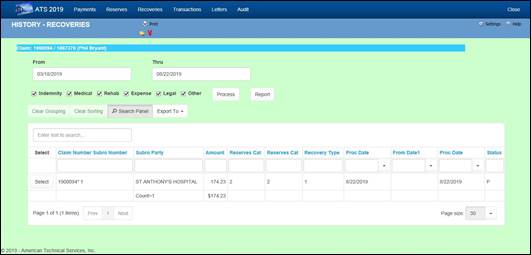

Figure 5‑23: Claim Recovery History

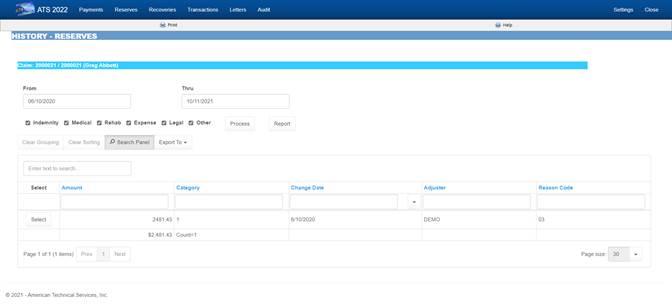

Figure 5‑24: Claim Reserve History

Figure 5‑25: Claim Letter History

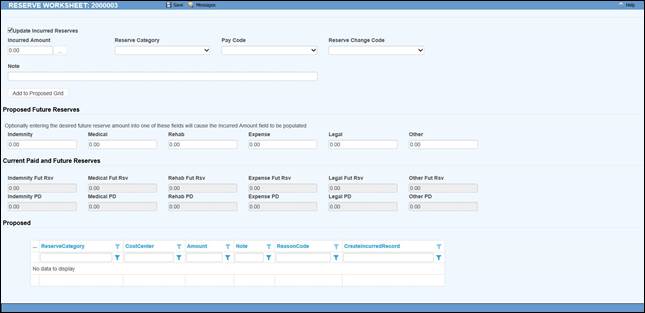

Figure 5‑27: Reserve Worksheet

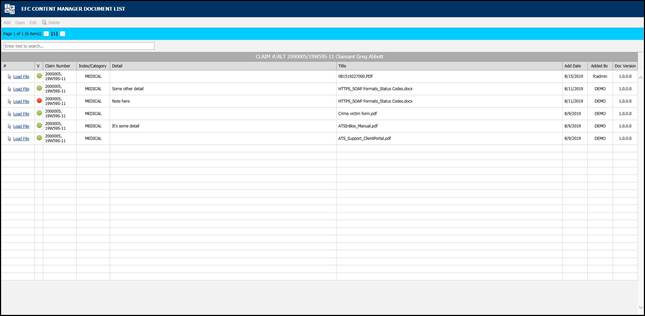

Figure 5‑29: EFC – Document Manager

Figure 6‑3: Sample Explanation of Benefits

Figure 6‑5: Batch Mode Filters

Figure 6‑9: Rebatch Payments Screen

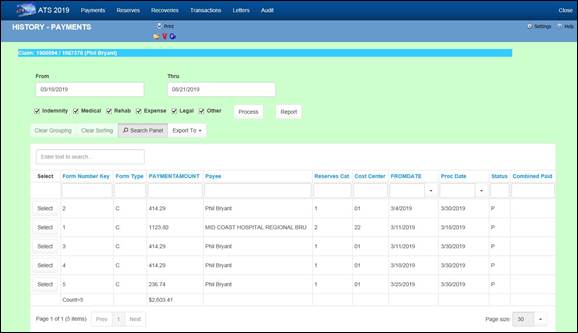

Figure 7‑1: Claim History - Payments

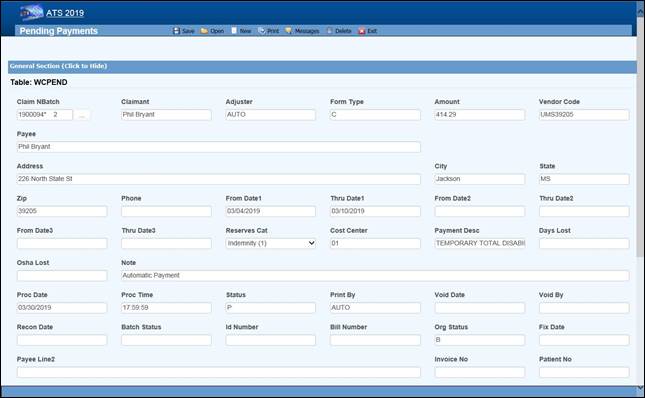

Figure 7‑2: Claim History - Payment Detail

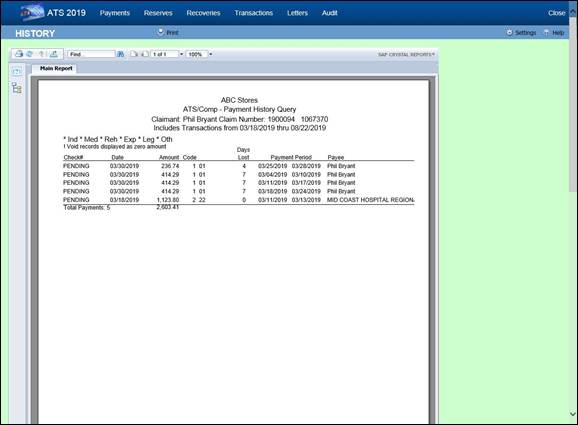

Figure 7‑3: Claim History - Payment Report

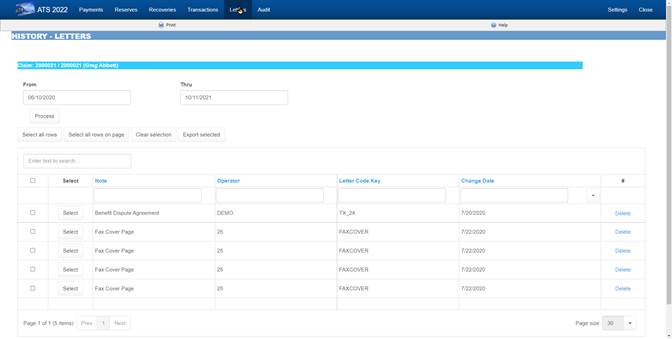

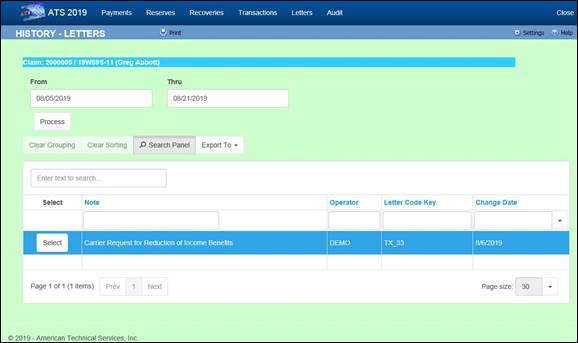

Figure 7‑4: Claim History - Letters

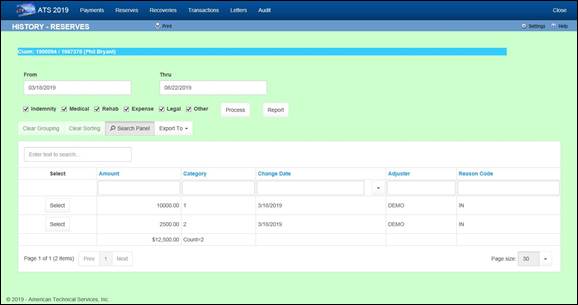

Figure 7‑5: Claim History - Reserves

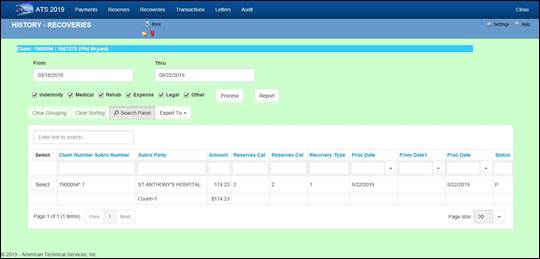

Figure 7‑6: Claim History – Recoveries

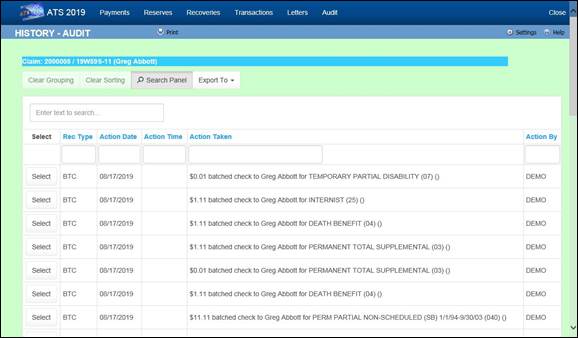

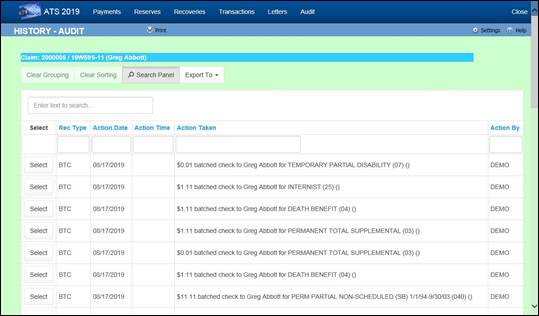

Figure 7‑7: Claim History – Audit

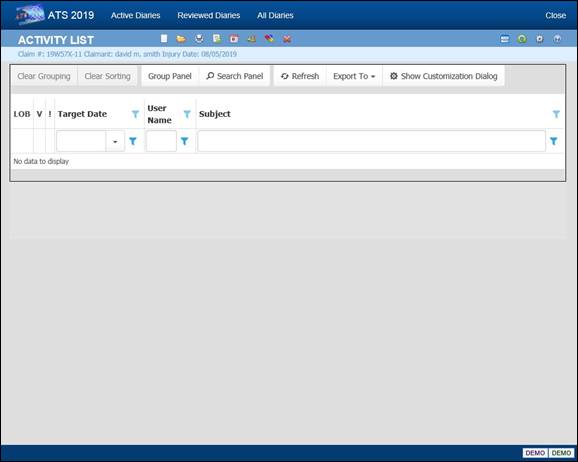

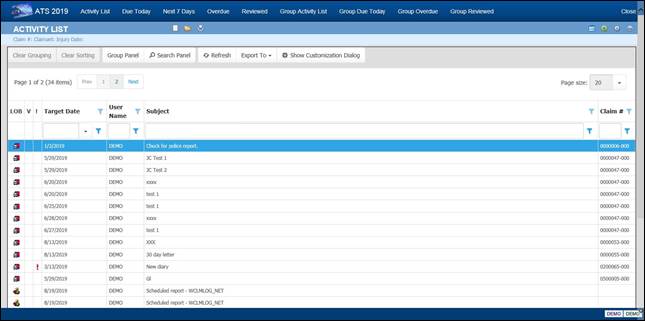

Figure 8‑1: Diary Activity List

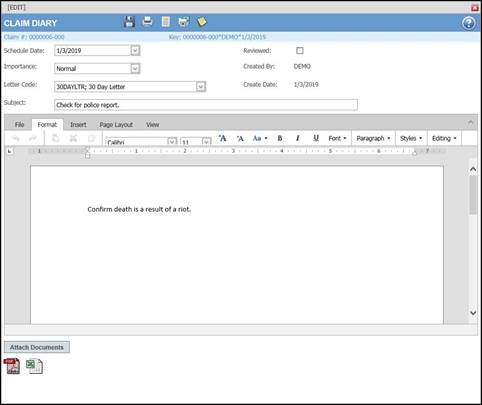

Figure 8‑3: Diary Entry Screen

Figure 8‑4: Diary Attachment Dialog

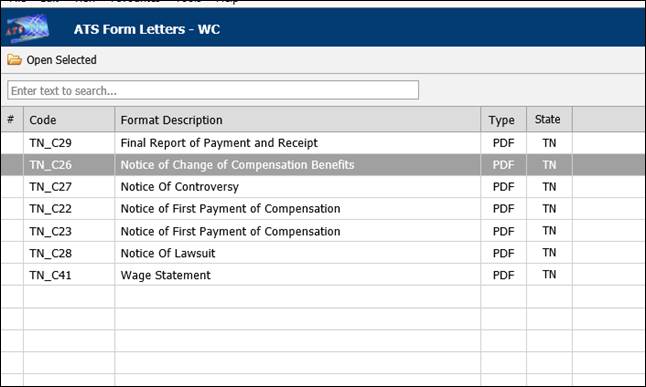

Figure 9‑1: Forms and Letter List

Figure 9‑2: Sample Generated Form

Figure 9‑3: Form Output Options

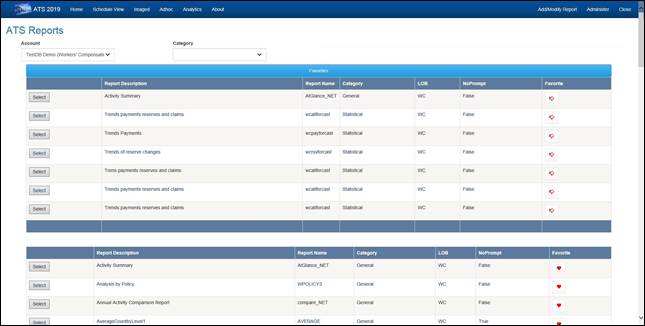

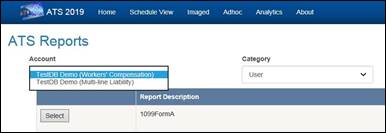

Figure 10‑2: Reports – Account Selection

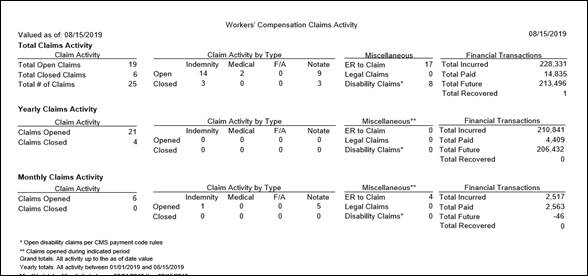

Figure 10‑3: Reports – Activity Summary Report Sample

Figure 10‑4: Reports –Activity Summary Parameter Entry Example

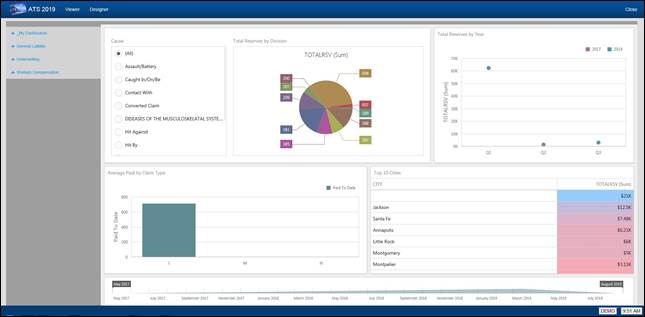

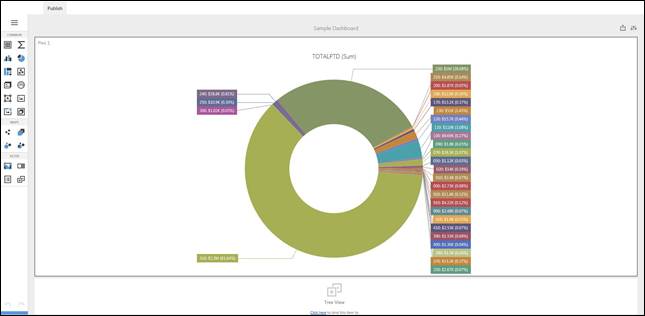

Figure 11‑2: Dashboard Designer

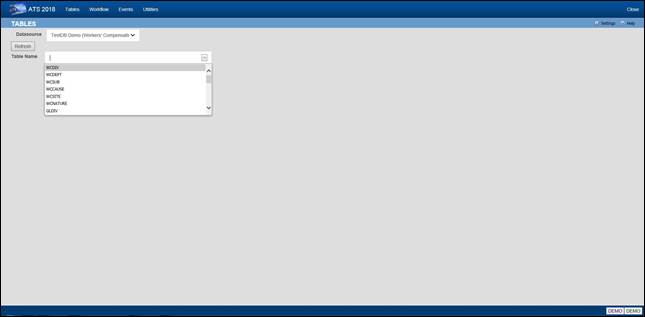

Figure 12‑1: Table Maintenance – Table Selection

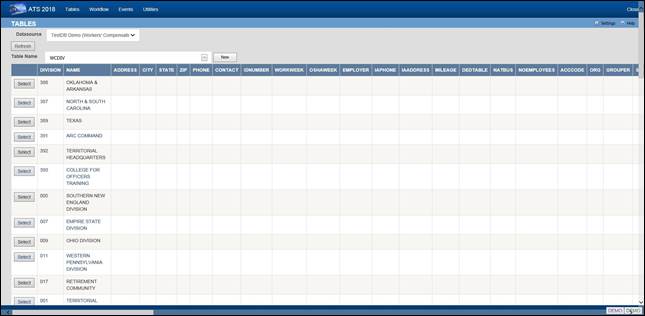

Figure 12‑2: Table Maintenance – Table Contents List

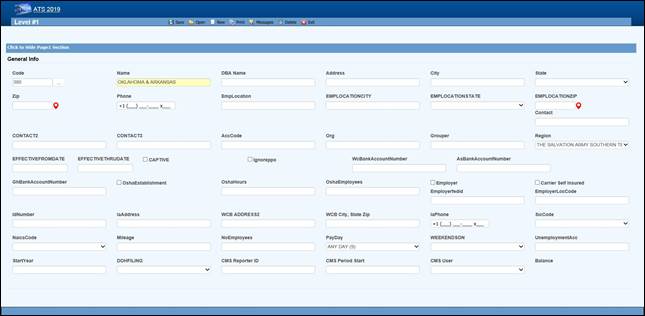

Figure 12‑3: Table Maintenance – Sample Editor Screen

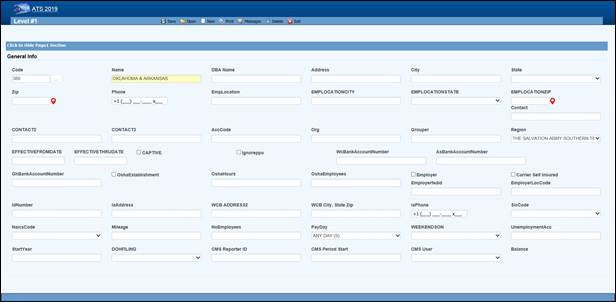

Figure 12‑4: Organization Maintenance – Level 1 Entry

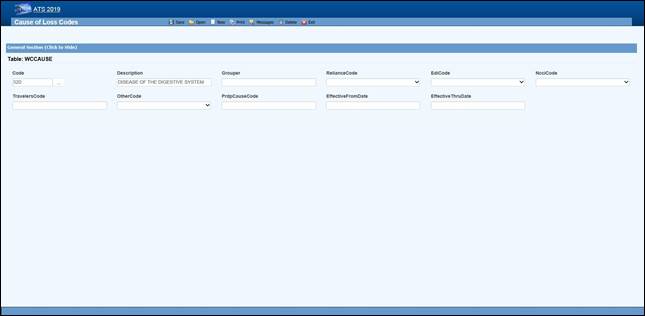

Figure 12‑5: Loss Maintenance – Cause Code Entry

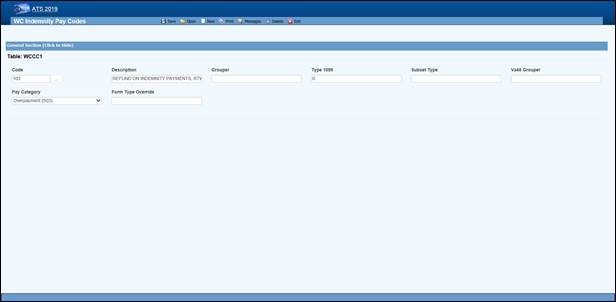

Figure 12‑6: Payment Maintenance – Cost Center Code Entry

This chapter covers the common features in ATS 2019. It explains how to use the various items you see in the main window, the ATS input screens, and the selection dialogs. Other chapters will guide you through the specific tasks you will be performing.

The ATS Workers’ Compensation Claim Administration module (ATS/COMP) is one of the most powerful applications on the market for administrating workers’ compensation claims, yet it’s easy to use. Data entry screens have been tailored to meet your requirements. On-line help is available if you have a question. Whatever your job entails, you will find that the system streamlines your workflow so that tasks get done quickly and efficiently.

This manual provides a complete description of the tasks that you can perform in the ATS/Comp system. Use it as a reference when you want to know how to use a specific feature. Technical information for the system administrator is documented separately.

The ATS manuals are designed to help you learn how to use the system quickly and efficiently. Each chapter begins with a brief overview of its contents. The remainder of the chapter discusses the features in depth.

The following conventions are used to identify special information:

|

Italics |

Specialized terms and titles of other books, chapters or sections in this manual. |

|

Arial |

Specific names of pages and dialogs. |

|

Open |

Specific names of buttons. |

|

New Claim |

Specific menu item selections, dialogs . |

|

<Ctrl>+X |

Keys that are used together as shortcuts to perform a specific operation. For example, <Ctrl>+P means hold down the Control key while pressing P. |

|

<Key> |

Special keys such as the Tab key which is shown as <Tab>. |

|

|

Important information related to the current topic. |

ATS/COMP is a browser-based application so you can launch the system by selecting the option from your list of Favorites in your browser or double-clicking the ATS 2019 icon on your desktop.

The ATS Login page provides secure access to the system. Each user must enter a Username and Password to gain access. In addition, if your organization has multiple instances of ATS 2019 running, you will need to select the Server too.

When all items are entered or selected, clicking the Log In button will validate your credentials and, if valid, log you into the system and will usually display the Console page. If your system is configured to require password changes on a regular basis, you may be directed to a password change page when you log in.

|

|

It is important to note that your login account could be configured to bypass the Console and display a different page. |

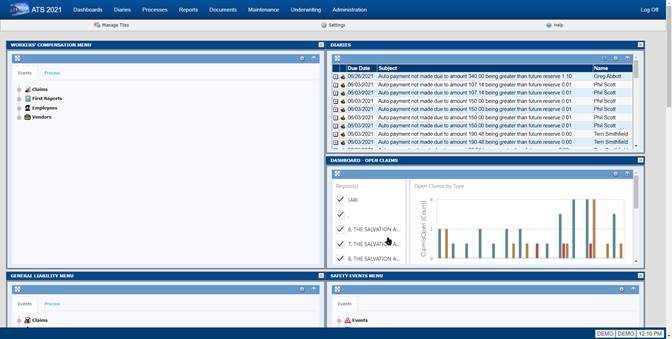

The main window that appears after login is referred to as the ATS Console because console is a synonym for "control panel". Regardless of whether you use one or all of the ATS products, the ATS Console will appear as the primary access point for the system.

The Console page consists of four (4) major components; the Menu Bar, the Toolbar, the Work Area, and the Status Bar.

The Menu Bar is located at the top of the page and provides access to major sections of the system, depending on your security settings.

The available menu options are as follows:

|

Menu Option |

Description |

|

Dashboards |

Provides access to interactive dashboards that provide analytical information about the contents of the database(s). |

|

Diaries |

Displays the workflow diary items for the user and, if a supervisor, the diary items of subordinates. |

|

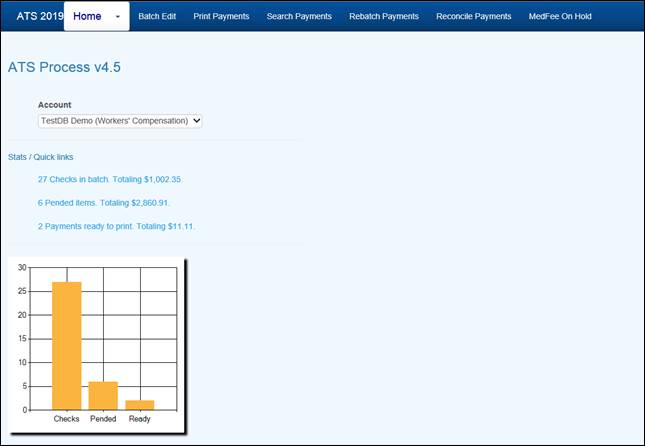

Processes |

The functions that generally affect multiple claims simultaneously, such as reviewing payments in batch and/or printing them. |

|

Reports |

Provides access to a wide variety of reports that include claims analysis, statistical, financial, and more. It also provides access to a general purpose tool for performing ad hoc queries against the ATS database(s). Knowledge of SQL is required to use this feature. |

|

Documents |

A repository for documents related to claims, incidents, first reports, etc. Documents can be in a wide variety of formats, such as; Word (.doc/.docx), Excel (.xls, .xlsx), Adobe (.pdf), Text (.txt), Graphics (.jpg, .gif, .png, etc.) and many more. |

|

Maintenance |

Allows users to maintain the look-up tables that the system uses for organization codes, loss codes, etc. |

|

Administration |

The features that allow administrators to configure the system-wide options that affect how the system will look and function, and features that are used to maintain the security settings for Users and Groups. |

When you click any of the options on the Menu Bar it will open a new tab or window (depending on your settings) with the selected component.

Toolbars in ATS 2019 contain tools, represented by icons and/or text, that provide access to processes and features associated with the current page or that act upon a selected item on the current page. The name of the current page is also displayed on the left side of the toolbar.

The following tools are available on the Console toolbar:

|

Icon |

Tool |

Purpose |

|

|

Manage Tiles |

Opens the tile selection screen to add or remove tiles from the work area. |

|

|

Settings |

Opens the settings dialog for the current screen. |

|

|

Help |

Opens the Help file associated with the current page. |

The Work Area of the Console page displays one or more Tiles. Each tile provides access to different information and functionality, such as; menus, claim lists, recently accessed items, diaries, email, system notices, graphs, statistics, and more.

The Work Area is fully configurable and you can modify it to meet your specific work requirements. The layout of the Work Area is like a grid. It can have from one (1) to five (5) columns and any number of rows. You can also set the width of each column.

The Status Bar displays messages on the left side. The right side displays the name of the database that you are connected to and the name of the user that logged in.

A Tile is a small window that provides access to a

particular set of functions. For example, Menu Tiles contain menu options that

allow you to easily access a particular feature, such as entering a New Claim

record or running a report. All tiles can be expanded to a full screen for

easier viewing and, in some instances, additional capabilities.

A Tile is a small window that provides access to a

particular set of functions. For example, Menu Tiles contain menu options that

allow you to easily access a particular feature, such as entering a New Claim

record or running a report. All tiles can be expanded to a full screen for

easier viewing and, in some instances, additional capabilities.

The following lists various Tiles available with ATS/COMP that are available at the time of this writing; however, new Tiles are being developed as time goes on.

|

Tile |

Tile Description |

|

|

The System Notices Tile displays general interest messages that have been created by authorized users and/or informational messages from the system, such as workflow task assignments and other reminders. The expanded page allows you to view all recent messages or notifications. |

|

|

The Open Claims Tile shows a list of all open claims that are assigned to the current user. Clicking on an item will open the associated claim record. The number of entries displayed can be set by the user. The expanded page shows the entire list of open claims assigned to the user. |

|

|

The Recently Accessed Tile shows a list of the most recently opened claims for the current user, in reverse chronological order. Clicking on an item will open the associated claim record. The number of entries displayed can be set by the user. The expanded page shows the entire list of recently accessed claims. |

|

|

The WC Reserves Dashboard Tile provides a quick view of the overall reserves set for the Workers’ Compensation claims in the system. The expanded page displays an interactive graphical dashboard that provides more specific information on the reserves. |

|

|

The WC Claim Types Dashboard Tile provides a quick view of the breakdown of claims by type for the Workers’ Compensation claims in the system. The expanded page displays an interactive graphical dashboard that provides more specific information for each claim type. |

|

|

The Open Claims Dashboard Tile provides a quick view of the overall number of currently open claims in the system, of each type. The expanded page displays an interactive graphical dashboard that provides more specific information on the breakdown of each type of claim. |

|

|

The Email Tile integrates with your email system to provide a list of current items in your inbox. Individual items can be opened and read. New email messages can also be created. The expanded page provides access to a fully functional email manager that includes a calendar, task list and more. |

|

|

The Diaries Tile provides a list of Diary/Workflow entries that are assigned to the current user. Entries are listed in chronological order by due date. Diaries can be opened, reviewed, marked as complete from the tile and new Diary entries can be created. The expanded page provides a complete list of all diaries for the current user and, if authorized, show diaries for members of a group. |

|

|

The WC Average Claim Cost Tile displays a graph that compares current, recent and historical cost data. The expanded page shows a larger view of the graph. |

|

|

The WC Injury Date Tile displays a graph that shows the frequency of injuries by month. The expanded page shows a larger view of the graph. |

|

|

The WC Indemnity Reserves Tile displays a graph that compares Reserves, Paid-to-Date, and Future Reserves for all open claims. The expanded page shows a larger view of the graph. |

|

|

The User Menu Tile allows you to create a menu that contains only the menu items you select. You can add as many or as few items as you choose, in order to make your job as efficient as possible. The expanded page displays the menu in a larger area. |

|

|

The Workers’ Compensation Menu Tile contains all available menu items for the module. The expanded page displays the menu in a larger area. |

|

|

The WC Events Menu Tile contains only those menu items that are located on the Events tab of the Workers’ Compensation menu. The expanded page displays the menu in a larger area. |

|

|

The WC Processing Menu Tile contains only those menu items that are located on the Process tab of the Workers’ Compensation menu. The expanded page displays the menu in a larger area. |

|

|

The WC Report Menu Tile contains only those menu items that are located on the Reports tab of the Workers’ Compensation menu. The expanded page displays the menu in a larger area. |

|

|

The WC Maintenance Menu Tile contains only those menu items that are located on the Maint tab of the Workers’ Compensation menu. The expanded page displays the menu in a larger area. |

|

|

The WC Administration Menu Tile contains only those menu items that are located on the Admin tab of the Workers’ Compensation menu. The expanded page displays the menu in a larger area. |

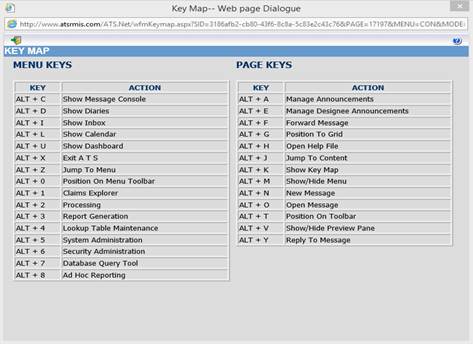

ATS products are ADA compliant so the menu options can be selected using the keyboard instead of the mouse. The list of keys available in the current window may be displayed with the Key Map button in the right pane by pressing <Ctrl>+K. There are actually two lists.

The first one lists the keys that may be used to access the options in the Navigation pane. The Page keys are the ones that may be used in the Selection pane. Since the items on the screen change depending on where you are in the system, the keys on the list will also change. Those listed below are available from the Explore window.

Some menus and commands appear only in certain parts of the system. The options on the menus that are unique to the Navigation pane in ATS .Net are described below.

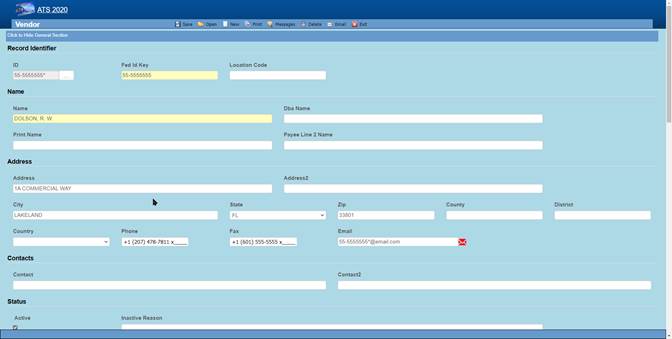

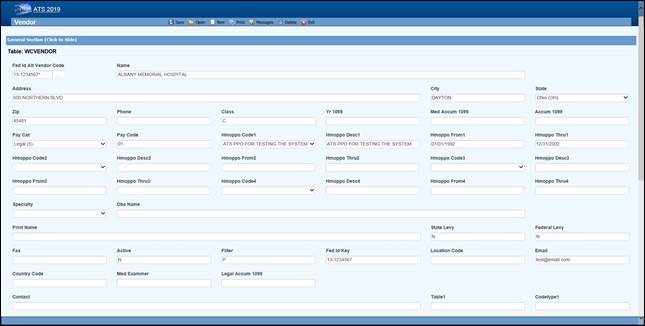

This section will cover the common features found in the ATS .Net input screens. The sample below is the standard screen used to enter Vendor information. Since ATS screens may be customized, there will be times when the screen on your system looks different than the one in this manual

Figure 1‑3: Sample Data Input Screen

Figure 1‑3: Sample Data Input Screen

To move through the fields or edit boxes on the screen, use the <Tab> or <Shift>+<Tab> keys or go directly to a specific field by clicking it with the mouse. Screens with multiple sections will have a special banner for each section to assist you in finding and/or entering information. To move to a specific section, scroll up or down the page or press <Alt>+<n> where n is the number of the section.

Normally, the input fields appear as white boxes on the screen. The majority of these are text fields such as those used to enter an address. Any printable character is considered valid. Depending on the field’s properties, letters will either appear as they are typed or transformed to upper case.

Numeric fields such as the employee’s wage will only accept numbers, commas, and periods (decimal points). All other characters are ignored.

Dates may be entered in a MMDDYY or MMDDYYYY format. Typically, the program will assume dates in the MMDDYY format are in the 21st century unless the date would be more than 25 years in the future. The slashes are automatically displayed as you enter the date. You may also click the key next to the field to pick the desired date from a calendar.

When phone or fax numbers are entered as ten digits such as 4101234567, the program will automatically display the formatted number as 1+ (410) 123-4567 where “1+” is the international dialing code for the United States. Enter the appropriate code if the number is for a foreign country.

ATS programs will recognize zip codes in the United States and fill in the corresponding city, county, and state.

Check boxes have replaced the Yes/No fields. Simply click the box to check it and indicate “Yes”.

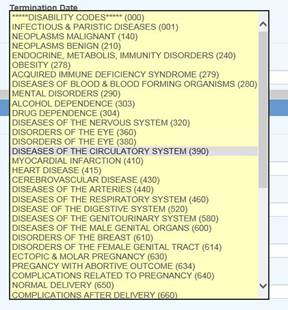

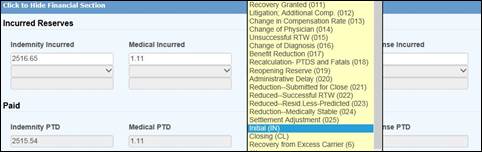

Since data entry speed and accuracy is important, selection lists are provided when a code is to be entered. Click the button next to the field to display a selection list like the one for cause codes shown below. The list will display the name/description of the item on the screen, followed by the code in parentheses. (It’s the code that is saved, not the description.) (Pages for maintaining lookup tables are accessible through the Maintenance option on the Menu Bar.)

Figure 1‑4: Cause Code List

Normally, required fields are displayed in yellow or red. In the sample input screen, the vendor’s search name field is required. A message will appear in the title bar if the name is missing when you try to save the record.

In some cases, the program will update certain fields on the screen. These are referred to as read- only fields. There are some of these on the Vendor’s Detail page. If you use ATS to produce the MISC-1099 forms, the program will write the amounts paid in the claim. Users can not modify these values.

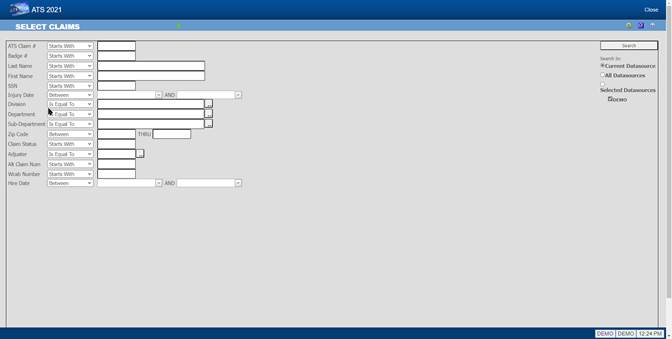

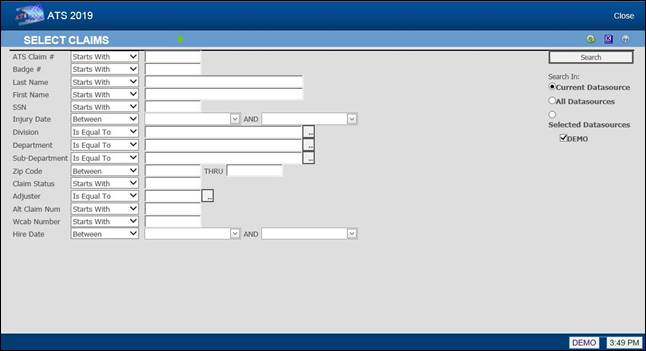

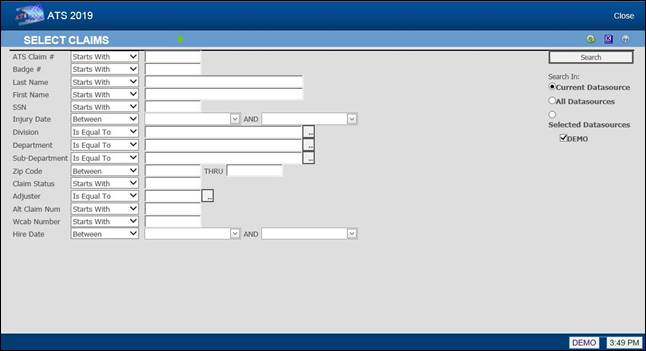

Note the Search In section on the right side of the screen shown below. If you have multiple data sources, this feature allows you to indicate the one(s) you want to use. When “All Data sources” is selected and you pick a claim (on the list of possible matches), the program will automatically make the data source active that is associated with the claim. Only one data source (DEMO) has been activated in our example.

|

|

Your company’s hierarchy may be divided into regions for tracking and reporting purposes. In that case, you may only have the right to access the claims in one or more of them. The program will display “Region Restrictions”. |

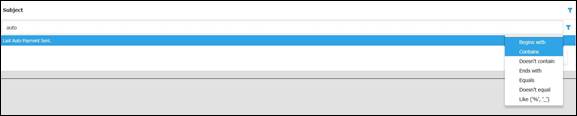

The ATS .Net system provides you with a variety of ways to find an existing record. The screen below illustrates how you might enter the criteria to search for a claim. Each item has a drop-down list of operations that can be used to qualify your search criteria. For example, selecting Starts With from the drop-down and entering the letter “A” in the Claimant Name field will return a list of all claimants with names that begin with the letter “A”. However, if you had selected Contains from the drop-down will list all claimants that have an “A” anywhere in their name. Note that the more criteria you use, the shorter the list of matches is likely to be.

Figure

1‑5: Claim Search Criteria

Figure

1‑5: Claim Search Criteria

When you are ready, click the Search button or press <Enter>. Unless you have entered a specific claim number, the program will display a list of choices that match your search criteria.

You can look up existing records by entering:

1. A specific value for an item. Selecting “Is Equal To” and typing “ATS” as the adjuster will display a list of claims for that user.

2. Characters that start, end, or exist somewhere in the data.

3. A wildcard. The percent symbol (%) may be used to indicate one or more characters. For example, entering “%” as the claimant name will list all claims regardless of the name. The underscore (_) represents a single character. For example: M%N will search for names that start with M and end with N; however, M_N will look for names that begin with M and end with N with one character in the middle.

4. A loss between two dates as shown above.

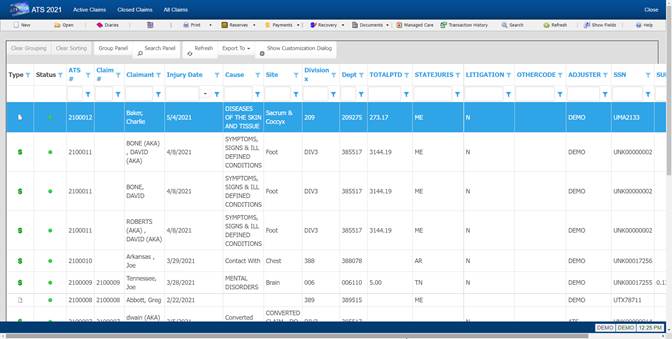

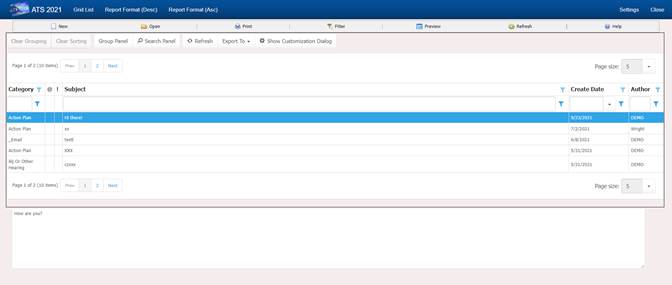

The program will search through the data source(s) using the selection criteria and display a list of records that match your specifications as illustrated by the example shown below.

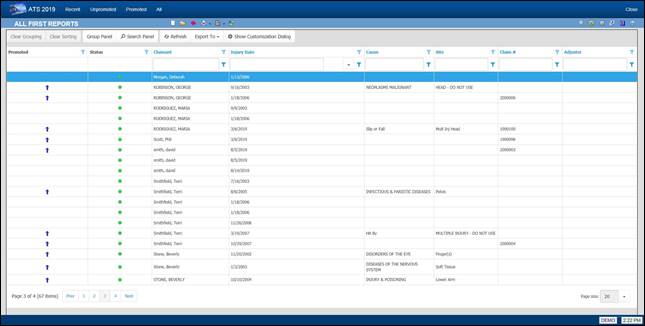

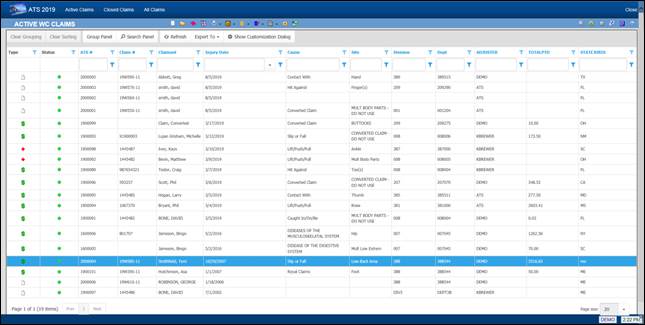

Figure 1‑6: Active Claims List

Figure 1‑6: Active Claims List

The arrow keys underneath the File menu allow you to look at other pages of possible matches when there is more than one. This snapshot shows that you are on page one of sixteen.

Click on any of the column headings to sort the list by the data in that column.

You can enter a value into the textbox at the top of a column to filter the records. Only records that match the value entered will be displayed.

Page navigation controls are located at the bottom of the page. You can go to the next or previous page by clicking the buttons on either side of the page numbers or you can click on one of the page numbers to go directly to that page.

You can use the Page Size control to set the number of entries to display on a page.

The employee must have a record in the ATS System before a claim or an employer’s report of injury can be entered for the individual. The Employee program is available after selecting the Explore menu and clicking the Employee tab on the Worker’s Compensation menu.

Note that if your company has another software package that tracks employee information, a custom interface may be provided to import relevant data into the ATS System in order to save time and ensure that the data is accurate.

![]() Users with appropriate access rights may enter employee records. You can use the New Employee item on a menu or the Open

button on the Employee

List to open the Employee data input page.

Users with appropriate access rights may enter employee records. You can use the New Employee item on a menu or the Open

button on the Employee

List to open the Employee data input page.

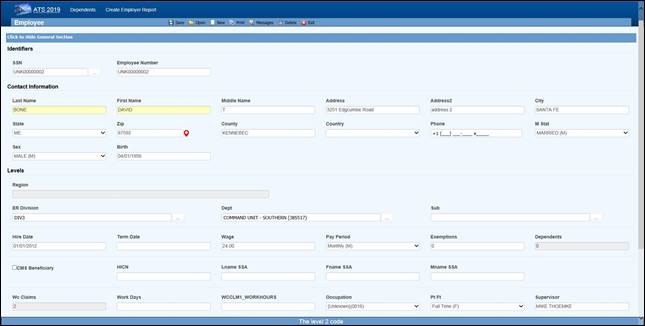

The standard screen used to track employee information is shown below with a sample record. Since the ATS System allows screens to be tailored to meet your organization’s requirements, your screen may look slightly different.

Note the fields related to the direct deposit feature will be hidden unless the user has the authority to use this feature.

Figure 2‑1: Employee Data Input Page

Figure 2‑1: Employee Data Input Page

The individual fields on the form are described as follows. Note that as soon as you enter the SSN, the program will search for an existing record with that SSN and display “Processing” at the top of the screen. If one is found that record will be displayed.

|

Field Name |

Description |

|

SSN |

This is a required field. New employees will automatically be assigned a number such as UNK00000028. When you type over this number, the program will insert dashes, if necessary, check to see if a record with that SSN already exists and, if so, display it on the screen. If you are not sure of the SSN, we recommend that you use the “UNK” number and edit the record when you have the information. Any existing claims will be updated when the record is saved. Note that during a data conversion, a “UNK” number is assigned when the SSN is missing or invalid. This feature makes it easy to find the records that need to be updated. |

|

Last Name |

The employee’s first and last names are required. This should be the name the person is known as. There are other fields for their legal name. |

|

First Name |

If a person changes his or her name, use the AKA feature to keep track of the previous name(s) so the claim and employee records can be looked up by either one. For details, refer to the AKA section. Note that is feature is in development so it may not be available in your current version. |

|

Middle |

A middle initial if any. |

|

Address |

Enter the address and the zip code. The program will automatically fill in the correct city, county, and state if the zip code is in the United States. |

|

Phone |

Phone numbers entered as 10 digits such as 4101234567 will be displayed as 1+ (410) 123-4567 where the “1+” is the international dialing code for the United States. |

|

Birth Date |

The employee’s date of birth. Enter the date in an MMDDYYYY format. The program will insert the slashes. |

|

Sex |

The employee’s gender. |

|

Marital Status |

The employee’s marital status may be selected from the drop-down list or entered using the appropriate code where M=married, S=single, D=divorced, and W=widowed. |

|

Hire Date |

The date of employment. |

|

Term Date |

The employee’s termination date if any. |

|

Last Transaction |

The ATS system will track changes made to fields in the employee record if a system administer has set them up as transactional. The program will display the last date one of the transactional fields was changed for informational purposes. |

|

Wage |

The employee’s wage during the specified pay period. |

|

Pay Period |

The employee’s pay cycle may be selected from the drop-down list or entered using the appropriate code where H=hourly, D=daily, W=weekly, B=bi- weekly, M=monthly, and A=annual. Note: When a claim or First Report of Injury is entered for the employee, the program will calculate the average weekly wage and write it into the record so it can be used to determine the employee’s benefit rate. |

|

Exemptions |

The number of exemptions is an optional field used to calculate any taxes withheld when making benefit payments in the A&S Disability product. (The same employee screen is used for both.) |

|

Dependents |

The ATS System will update this field and display the total number of dependents for the employee as records are added and/or removed. The number may not be edited. (See the Dependents section.) Note: The Dependents module may be used when 1. The employee's wages have been garnished and a lien needs to be set up (e.g. child support). 2. The number of dependents affects the Workers' Comp benefit rate. 3. There is an additional claimant for a Medicare beneficiary who is deceased. |

|

# Claims |

The program will increment this value as claims are entered for the employee. This field may not be edited. |

|

CMS Beneficiary |

A check in this box indicates that the employee is a Medicare beneficiary. Normally, the check is entered by the program that processes the CMS Query Response file. |

|

HICN |

The Medicare health insurance claim number will be filled in with the data in the CMS Query Response file. |

|

Last Name (SSA) First Name (SSA) Middle Initial |

The employee’s name as known by the Social Security Administration if it’s different than the one used in the rest of the Worker’s Compensation system. If the employee is a Medicare beneficiary, this name will be sent when submitting a report to the CMS (Centers for Medicare and Medicaid Services). |

|

Division Dept Sub

|

The levels that indicate where the employee works within the company’s hierarchy are called Division, Dept, and Sub by default. These labels have probably been changed on your screen. Levels may be entered in the following ways depending on how your system has been set up: 1. Pressing the Ellipsis button in any level field will display a list of all the available entries. This is the default. 2. If the Level 1 and 2 fields are blank, you may be able to enter a Level 3 to have the program automatically fill in the associated levels. |

|

Occupation |

The employee’s occupation. Press the Ellipsis button for a list of choices. |

|

Employment Type |

The employee’s status such as full-time and part-time. Press the Ellipsis button for a list of choices. |

|

Employee # |

The number assigned to the employee by the company. It may be entered in the Employee Selection dialog to look up a record. This ID number may be used to ‘identify’ the employee in certain cases where the SSN may not be displayed for privacy reasons. |

|

Supervisor |

The name of the employee’s supervisor. |

|

Notes |

A short note pertaining to the employee. For example, “Employee hired for project number J3466”. |

|

Direct Deposit |

Direct deposit is an optional, add-on module. A check in this box indicates that the employee wants his/her benefit payments deposited directly in the bank. Depending on the user’s security settings, these fields may not be visible. |

|

Routing Number |

The bank’s routing number. |

|

Bank Account |

The employee’s bank account number. |

The program will display a message indicating that the record has been saved successfully. At that time, the employee’s name and SSN or ID will be displayed in the window’s title bar. If you have skipped over any of the required fields, the “Required fields missing” message will appear. Enter the data. When you are done, save the record again.

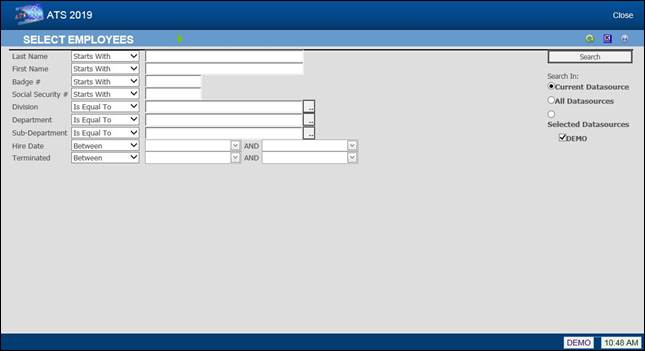

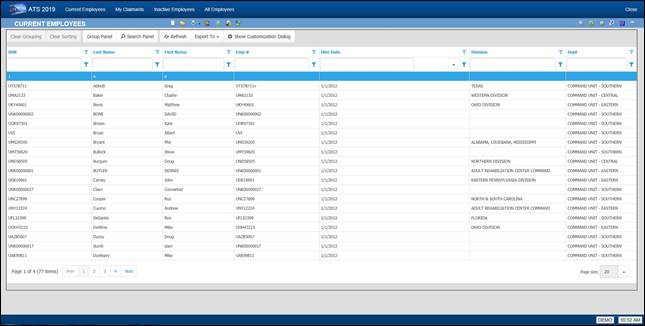

The Employee menu provides a number of options to find the record you want to view and/or modify. The first option, the Selected Employees search, lists a variety of criteria you can use to quickly find the record. The standard list is shown below. The criteria on your system may be different.

Figure

2‑2: Employee Search Criteria

Figure

2‑2: Employee Search Criteria

There are other ways to look up records. The options are as follows:

|

Menu |

Function |

|

Claimants |

Lists all claimants with claims where the Adjuster is the current user. Current Employees Lists all employees that are currently working for the organization. |

|

Current Employees |

Lists all employees that currently work for the organization. |

|

Inactive Employees |

Lists all employees that have left the organization (i.e. a Termination Date exists). |

|

All Employees |

Lists all employees whether or not they are currently working for the organization. |

Figure 2‑3: Employee Search Result

List

Figure 2‑3: Employee Search Result

List

Note that if the Region by Level feature has been implemented and Region View has been set, you will only be able to see a list of the employees in your specific region.

However, you find the employee, make the desired changes. When you are done, save the record and exit the program.

If a system administrator has set the Query Employee Changes flag using the Module Parameters screen, the program will check the employee’s name, address, phone, supervisor, birth, and/or termination date. If any information has changed, you will be asked if the individual’s claims and reports of injury should be updated.

|

|

When an employee’s social security number is changed, all the appropriate tables will be updated automatically. |

![]() Some employees sustain a

number of injuries while they work for a company. If you need to enter a

report for a person that already has an existing employee record, we recommend that you edit the record to make sure that the information is

current. When you are finished, you may use the New Employer’s Report button to continue.

Some employees sustain a

number of injuries while they work for a company. If you need to enter a

report for a person that already has an existing employee record, we recommend that you edit the record to make sure that the information is

current. When you are finished, you may use the New Employer’s Report button to continue.

![]() The same suggestion

applies when you need to enter a claim. When you are finished verifying that

the employee’s data is up to date, you may use the special New Claim button

to continue.

The same suggestion

applies when you need to enter a claim. When you are finished verifying that

the employee’s data is up to date, you may use the special New Claim button

to continue.

People are often known by more than one name. The name in the employee’s record and their open claim(s) should be the same as it is the one that will appear on all payments issued to the employee.

Any other name the employee uses should be entered as an alias using the AKA feature. For example, a woman often takes her husband’s name when she gets married. In that case, you should enter her new name in the Last Name field and her maiden name as the alias. After that you will be able to find the employee and the associated claim records using either name. This is done automatically by the system.

There are a number of reasons for creating dependent records. Some of them are:

1. The employee was a Medicare beneficiary and is now deceased. Dependent records must be entered for any “Additional Claimants” that need to be submitted to the CMS (Centers for Medicare and Medicaid Services).

2. The individual wants to attach a lien to the employee’s payments or be considered when calculating the benefit amount for a claim.

3. The individual is the employee’s beneficiary and entering the person as a dependent will simplify the payment process for a fatality claim.

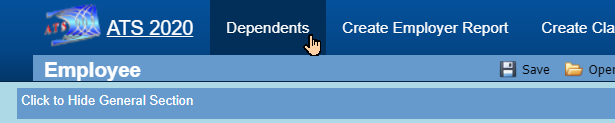

To

enter a new record or modify an existing one, click the Dependents button

to display the Dependents

List.

To

enter a new record or modify an existing one, click the Dependents button

to display the Dependents

List.

Figure 2‑6: Employee Dependent List

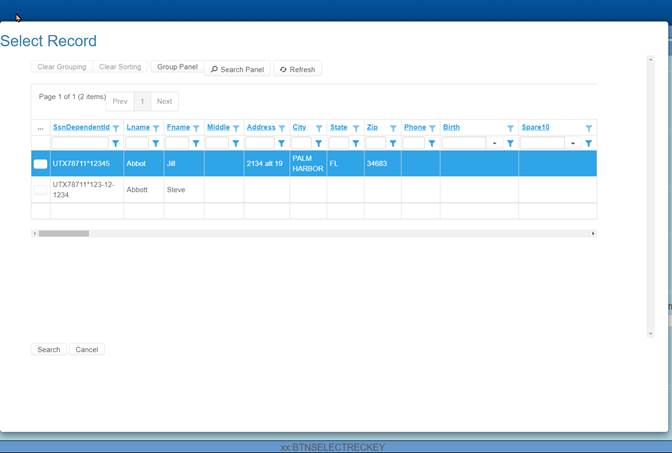

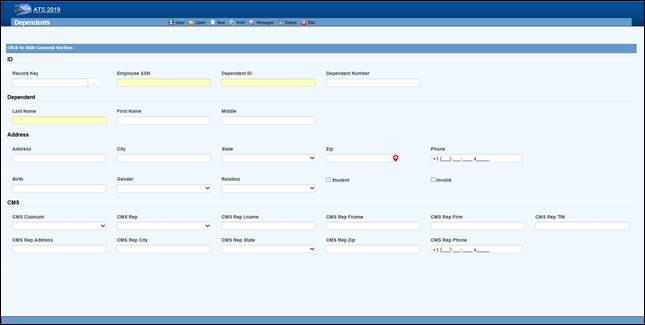

Click on the new button. The following screen will appear. Enter all pertinent data and then click Save. The dependent record is now available to use.

Figure 2‑7: Employee Dependent Data Input

Figure 2‑7: Employee Dependent Data Input

The fields on this screen are described as follows:

|

Field Name |

Description |

|

SSN |

A valid SSN should be entered for the individual. |

|

Last Name First Name M.I |

The complete name if the dependent is an individual. If the dependent is an estate, enter “The Estate of <employee>”, “the Family of <employee>” or “The Trust of <employee” depending on the entry in the Relationship field. In any case, leave the other name fields empty. |

|

Address |

The individual’s address, city, state, and zip code |

|

Phone |

The individual’s phone number. |

|

Birth Date |

The individual’s birth date is important if the state of jurisdiction for the employee’s claim has an age limit for tacking deductions for dependents (when calculating the benefit rate). |

|

Gender |

The individual’s gender if relevant. |

|

Relationship |

The dependent’s relationship to the employee. The valid options are: F = Family Member, Individual Name Provided O = Other, Individual Name Provided X = Estate, Entity Name Provided (e.g. "The Estate of John Doe") Y = Family, Entity Name Provided (e.g. "The Family of John Doe") Z = Other, Entity Name Provided (e.g. "The Trust of John Doe") |

|

Student |

A check indicates that this individual is a student. |

|

100% Dependent |

A check indicates that the dependent is to continue being on a claim’s eligible list regardless of age. |

|

Additional CMS Claimant |

This number from C1 to C4 must exist in the record in order for the dependent’s data to be submitted to the CMS. |

|

Type of Rep |

The type of representative for the dependent. Valid choices are: · Guardian/ Conservator · Attorney · Power of Attorney · Other |

|

Name Address... |

The rest of the fields for the representative are self-explanatory. |

Saving a new record (or deleting an existing one) will update the # of Dependents for the associated employee.

Any individual or company that provides a service associated with a claim is considered a vendor in the ATS system. If you use some other software package that tracks vendors, your system may be customized to import the relevant data to save time and ensure accuracy.

Operators with the appropriate access rights may use the Vendor tab to enter a new record. The first of the two sections is shown below.

Figure 3‑1: Vendor Page - General Section

Figure 3‑1: Vendor Page - General Section

The first section (General) contains general information on the vendor. The fields are described as follows:

|

Field Name |

Description |

|

Tax ID |

Although any code may be entered for tracking purposes, a valid federal ID or social security number must be entered if a 1099 will be filed. The ATS system often refers to a vendor code which is the tax ID, an asterisk, and the location code if any. In the example above, the vendor code is 77-7878787* since the location code is blank. |

|

Location Code |

A code should be entered when a vendor has multiple locations that use the same tax ID. For example, a medical clinic with several offices may have one tax ID and a unique location code for each office. When looking up an existing record, enter the tax ID into the Vendor Selection dialog and all of the locations with that number will be listed. Note: This field is also referred to as the Alternate Vendor Code. |

|

Search Name |

The name to be used for lookup purposes. If the vendor is an individual such as John Brown, we recommend entering a Search Name as “Brown, John” so that the record is easier to find. In that case, the person’s real name should be specified as the Print Name to be displayed on a check or voucher. |

|

Address |

The complete mailing address. A second line may be used if necessary. |

|

City |

The vendor’s city. |

|

State |

The vendor’s state code. |

|

Zip |

The zip or postal code. |

|

District |

The district or region where the vendor is located. |

|

Country |

The code for the country where the vendor is located if outside the US. |

|

Phone Fax |

The vendor’s phone and fax numbers. Enter 10 digits such as 4101234567 and the program will display 1+ (410) 123-4567 for a US number. |

|

|

The vendor’s e-mail address. |

|

Contacts |

The name of a contact person or two. |

|

Active |

A check indicates that the vendor is active. If the box is unchecked, the Payment program will not allow payments to be issued to the vendor. Since vendor records are normally kept in the system for historical purposes, we recommend that you use this feature to indicate that the vendor is inactive instead of deleting the vendor’s record. |

|

Reason |

The reason why the vendor is considered inactive may be entered when needed. |

|

Rsv Category Pay Code |

The default reserve category and pay code to use when making payments to the vendor. For example, if the vendor is a hospital, enter “2” or Medical as the reserve category and the appropriate pay code. The fields will be automatically filled in when making payments to the hospital. |

|

Filter |

The Claims program will use this code to generate the lists that appear when selecting vendors. If an “A” (attorney) is entered, the vendor will only appear when selecting a legal firm for the claimant or defense. When an “P” is entered, the vendor will only be listed as a medical or rehab provider. |

|

NPI |

The National Provider Identifier assigned to medical care providers. |

|

Biller ID |

A code or number assigned to the vendor by the accounting department. |

|

DBA Name |

The “doing business as” name should be entered for vendors classified as individuals for 1099 reporting purposes. |

|

Print Name |

The name to be printed on payments made to this vendor. If this field is empty, the Search Name will be used. |

|

State/Federal Levy |

Check the box if the Payment program should display a message indicating that the vendor has a state or federal lien. |

|

Specialty |

Press the Ellipsis button to select from a list of available codes. |

|

Examiner # |

The medical examiner number required in certain states such as Florida. |

|

Work Status |

A special field used in the PERI Interface. If this data is required by the PERI Data Exchange, press the Ellipsis button to select from a list of available codes. |

|

Direct Deposit |

Check this box if the vendor is to receive payments electronically. |

|

Routing Number |

The routing number for the vendor’s bank. |

|

Bank Account |

The vendor’s bank account number. |

The second screen contains the information needed to produce the 1099-MISC returns. The rest of the fields are used in the optional Medical Fee - Bill Review module.

Figure 3‑2: Vendor Page - Finance Section

Figure 3‑2: Vendor Page - Finance Section

The fields in the Finance section of the page are described as follows:

|

Field Name |

Description |

|

W-9 on File |

Check this box if the W-9 is on file. |

|

W-9 Expiration |

The date the current W-9 expires. |

|

Class |

Exempt indicates that the vendor should not receive a 1099. If you file your 1099s electronically, enter Individual if the vendor's tax ID is a social security number, otherwise it will be reported as a federal ID. In either case, the program will strip out all dashes and report a nine digit number. |

|

Primary Vendor |

If there is more than one vendor with the same tax ID but different location codes, use this field to indicate the Primary Vendor that should get the 1099. |

|

Name Control |

Filing Electronically: The name control should be the first four significant letters of the name excluding spaces and titles such as Mr. and Dr. |

|

2nd TIN Notice |

A check indicates that you have received two notices within three years stating that the vendor's tax ID is incorrect. The 1099 program will also check this box on the form so the IRS will not send any further notices regarding this vendor. |

|

Special Data |

Filing Electronically: This field may be used to enter special data to be included when using the 1099 Combined Federal/State Filing program. |

|

1099 Year |

The 1099 Accumulation program will enter the year to be reported. |

|

1099 Other 1099 Legal 1099 Med 1099 Misc |

The 1099 Accumulation program will update the 1099 Other (Income), Legal, Medical and Misc (Non-employee Comp) fields with the payments for pay codes that have 3, C, 6, or 7 as the 1099 Type value. Refer to the 1099 Reporting Information below to find out which record gets updated when there is more than one vendor with the same tax ID. |

|

Service Zip |

The zip code where the vendor provides service. |

|

HMO/PPO Info |

Press the Ellipsis button for a list of valid HMO/PPO providers. Selecting a code will automatically display the description and the range of dates when valid. Up to four may be used when making payments to the vendor with the Medical Fee module. The program will check to see if there is an HMO/PPO that covers the From Date in the payment record. If so, the program will use the alternate rate table for the HMO/PPO when reviewing the billed items. |

|

Facility |

The type of facility when it affects the repricing of medical bills. |

|

Vendor Type |

The type of vendor to use for DOH filing purposes. |

|

PPS Exempt |

Check this box if the vendor is exempt from PPS. |

|

Paid as Billed |

Check this box if medical bills should NOT be reduced for some reason (e.g. the vendor is under the Maryland Health Services Cost Review Commission). |

|

Notes |

Any notes regarding the vendor. |

A medical clinic with several offices may use one tax ID and a unique location code for each office. When the 1099 Accumulation program is launched with the Combine Vendor option, the first record for the vendor is normally used by default. In this example, the one with the blank Location would be considered the primary vendor to receive the 1099. (When sorted, numbers come before letters.)

|

Tax ID |

Location |

1099 |

|

94-1234567 |

|

YES |

|

94-1234567 |

110A |

NO |

|

94-1234567 |

ABC |

NO |

If the primary vendor is not the first record, check the Primary Vendor box so it will be updated by the 1099 Accumulation program.

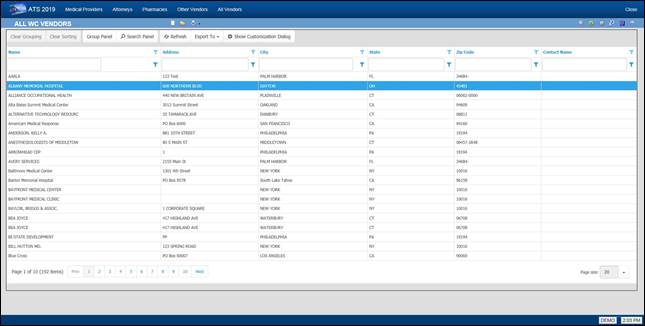

The Vendor menu provides a number of standard options that will return pre-defined results lists based on the value of the Filter field on the Vendor record or some other criteria.

· Medical Providers (Vendors with a Filter = “P”)

· Attorneys (Vendors with a Filter = “A”)

· Pharmacies (Vendors with a Filter = “R”)

· Other Vendors (Vendors with a Filter = “O”)

· All Vendors (Vendors on claims where the current user is the adjuster)

Optionally, Selected Vendors can be used to locate the record you want to view and/or modify. The Selected Vendors page displays a number of fields for input of search criteria that will be used to find matching records. By default, the system looks for active vendors. If you need inactive vendors, change the active filter in the list to “NO”.

Note that the following example uses the standard result list. The one on your system may be different. The search and filter features on the results list page can be used to further narrow down the results.

Figure 3‑3: Vendor Result List

Figure 3‑3: Vendor Result List

If the Tax ID or Location is changed, every payment made to the vendor will be updated for (1099) reporting purposes, even those that are still in batch. Any batched payment will also be updated when the address is modified. In that case, the historical payments will not be changed.

The Employer’s Report of Injury module is an optional, add-on module designed to assist you in filing a First Report of Injury (FROI) with the State. The module allows you to:

· Create a new report according to the state’s current specifications and format.

· Print the report and/or write selected fields to an export file to be sent electronically to the state.

· Determine whether adequate safeguards and equipment were provided and if the employees used the safety measures.

· Promote the report when a claim has been filed to eliminate having to retype the relevant information.

Creating a report is a simple process. To begin, select New FROI from a menu or click the New button on the Employer’s Report result list. When the Select Employee screen appears, use any of the lookup options to find the desired record.

A record for the employee must exist before a report of injury can be entered. If a record is not found, the Employee must be added.

The next step is to indicate the state of jurisdiction. The employee’s state is selected by default, but you may change it to that of the employer or choose another state from the list.

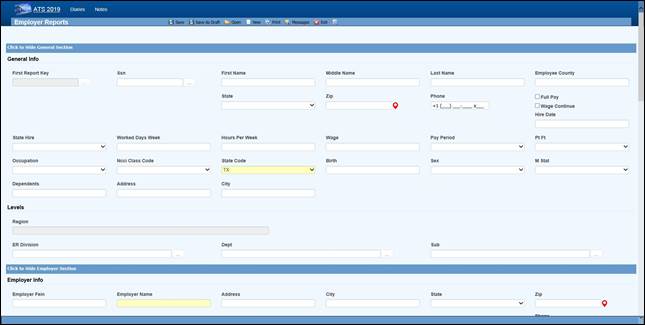

Click Select to display the screens for the specified state. Although every state has its own form for filing purposes, much of the information is the same. To simplify the input process for those companies that deal with multiple states, ATS has used the same general layout for the screens regardless of the state.

For documentation purposes, we have selected the screens for Illinois since that state uses the IAIABC form which is considered the standard. The General section is shown below with the personal information such as the address, phone number, date of birth and hire date read from the employee’s record. The employee’s name is displayed in the title bar for your convenience.

Figure 4‑1: Employer’s Report Page

- General Section

Figure 4‑1: Employer’s Report Page

- General Section

Typically, you will be asked to enter the additional information described below. Other fields may be provided depending on the state of jurisdiction.

|

Field Name |

Description |

|

State of Hire |

The state in which the employee was hired. |

|

Days per Week |

The average number of work days/week. |

|

Hours per Day |

The average number of hours worked/day. |

|

Day of Injury Paid |

A check indicates that the employee was paid for the day on which the injury/illness occurred. |

|

Salary Continued |

A check indicates that the employee is receiving his/her regular salary in lieu of worker’s compensation benefits. |

|

Wage |

The program calculates and displays the employee’s weekly salary. |

|

Period |

The pay period is always “Weekly”since the State wants to know the AWW. |

|

NCCI Class Code |

The NCCI classification code may be required if it’s on the state’s FROI. |

Press <Alt>+2 or scroll down to position to the Employer section that contains the employer and level information. Note the Dept, Division, and Sub in the following example. The labels used to identify the levels will vary depending on how your system has been set up with the Administration- Configuration-Application Parameters menu.

Any information that is not required by the IAIABC will have to be entered manually, but the standard information in the following example will be displayed automatically if it exists.

Figure 4‑2: Employer’s Report Page

- Employer Section

Figure 4‑2: Employer’s Report Page

- Employer Section

|

|

It is important to understand how the program searches for the person’s employer in case some information is missing. First, it looks at the levels specified for the employee to find a record where the Employer box is checked. If one is not found, the program will see if the employee’s region or state is marked as the employer. The client is assumed to be the employer if no other one is found. |

|

|

· Level 3 (starting with Sub 3 and Sub 2 if used) · Level 2 · Level 1 · Region · State · Client |

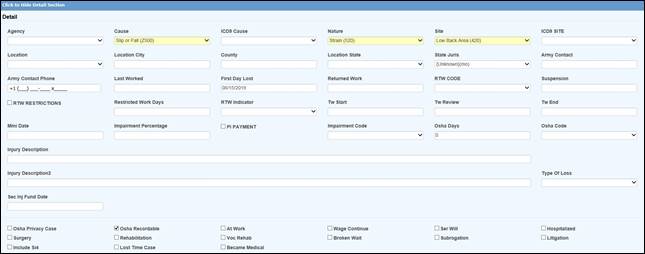

Information about the injury or illness should be entered in the Detail section. Since each State form is different, the fields will vary. The ones on the IAIABC form are shown below.

Figure 4‑3: Employer’s Report Page

- Detail Section

Figure 4‑3: Employer’s Report Page

- Detail Section

The following fields are on the IAIABC form. Depending on the state, the program may prompt you to enter additional information.

|

Field Name |

Description |

|

Injury Date |

The date of injury is required. A dialog will appear if there is an existing report for the person on the same date. Depending on what you see, continue entering the new report or exit the program. |

|

Time Began Work |

The (military) time the employee started to work (e.g. 1430) on the day of the injury. The colon will be inserted for you. |

|

Time of Injury |

The time of injury in a military format. |

|

Last Work Date |

The last day the employee was at work. |

|

Knowledge Date |

The date the employer learned of the injury. |

|

Disability Start Date |

The date disability payments began (i.e. the first day lost due to the injury or illness). |

|

Report Purpose Code |

The state’s code that describes the reason for submitting the report. |

|

Location/Dept. |

The location where the injury or illness occurred. |

|

County |

The county where the injury occurred. |

|

Employer’s Premises |

A check indicates that the injury/illness occurred at the work place. |

|

Safeguards/safety equipment provided |

A check indicates that the employer provided safety measures. |

|

Safety Measures Used |

A check indicates that the employee used the safety measures that were provided. |

|

Returned to Work |

Check the box and enter the date if the employee is back at work. |

|

Fatal Injury |

A check indicates that the employee died as a result of the injury/illness. If so, enter the date of death. |

|

|

The fields in the Details section that indicate whether safety measures were provided and/or used may not be required by the State, but ATS considers these standard fields since they can provide valuable information for reporting purposes. |

All States require you to describe the incident in detail. The fields in the Loss Description section indicate where the information should be entered so the Report of Injury will be filled out correctly.

Figure 4‑4: Employer’s Report Page

– Loss Description Section

Figure 4‑4: Employer’s Report Page

– Loss Description Section

The Loss Codes section allows you to enter more details about the injury. The screen shown below will appear regardless of which state was specified.

Although a state may not request this information on the report, the loss codes you enter will be transferred along with other pertinent data if the report is promoted to a claim. These fields may also provide valuable information for reporting purposes.

Figure 4‑5: Employer’s Report Page

– Loss Codes Section

Figure 4‑5: Employer’s Report Page

– Loss Codes Section

The Medical section is provided so you may enter information on the initial treatment that was provided along with the physician, hospital, or off-site facility that was involved.

The information on the screen shown below is requested on the IAIABC form. Since more and more states are adopting this form, the Medical tab will display this screen regardless of which state you have specified.

Also note the Initial Treatment code. If this is required, someone with the authority to maintain the Loss Codes must enter these codes before they can be used in a report of injury.

Figure 4‑6: Employer’s Report Page

– Medical Section

Figure 4‑6: Employer’s Report Page

– Medical Section

The Admin section is shown below. Many states request information on the company which will be handling the injury report. This is your company if you are adjudicating your own claims or doing business as a third-party administrator (TPA). In either case, the program will automatically fill in the information if it has been entered in the Agent record. A sample screen is shown below.

If required, the Date Notified may be interpreted differently on your state form. Although this is usually the date the claim administrator or insurance carrier received the First Report of Injury, in Massachusetts it is the date the injury or illness was reported as work related. Please refer to the help message when in doubt as to what to enter.

Figure 4‑7: Employer’s Report Page

– Administrator Section

Figure 4‑7: Employer’s Report Page

– Administrator Section

All of the insurance carrier information on the IAIABC form may be entered in the Carrier section. If your company is self-insured in the state or has only one carrier, a system administrator may use the Field Properties feature to enter the pertinent information as default values so it does not have to be typed into each new report.

If the Policy module is in use, one may be attached after the report of injury has been saved.

Figure 4‑8: Employer’s Report Page

– Carrier Section

Figure 4‑8: Employer’s Report Page

– Carrier Section

The special fields on this screen are described as follows:

|

Field Name |

Description |

|

Self-Insured |

A check will indicate that carrier is the self-insured employer. |

|

Policy |

The carrier's policy that will used, if the report becomes a claim, plus the dates it is valid. |

|

Agent |

The agent’s code and name. |

|

Insured’s Number |

The insured’s report number to display on the FROI if necessary. |

|

OSHA Case Number |

The OSHA case number, if it is different than the ATS claim number. |

|

State Claim Number |

The claim number assigned by the state of jurisdiction. |

The last section, Summary, contains the information shown in the example below.

Figure 4‑9: Employer’s Report Page

– Summary Section

Figure 4‑9: Employer’s Report Page

– Summary Section

The fields on the screen are described as follows:

|

Field Name |

Description |

|

Promoted to Claim |

The program will check this box if the report is promoted. (See a later section.) |

|

Claim Number(s) |

The claim number assigned when the report is promoted. Depending on how your system has been set up, an alternate claim number may be assigned at the same time. |

|

EDI Date |

The date the record was batched for transmission to the State. This may not be the date it was actually transmitted. |

|

Completed By |

The name of the person submitting the Employer’s Report to the State. (Required) |

|

Title |

The title of the person submitting the Employer’s Report. |

|

Phone |

The phone number of the person submitting the Employer’s Report. |

|

Date |

The date the Employer’s Report was completed. |

After entering the relevant information, click the Save button. If the “Required Fields Missing” message appears in the title bar, enter the data and click Save again.

|

|

Although a State may require certain information on the reports, there are very few required fields on the ATS screens because we realize that an operator may not have all the information at the time the report is created. We don’t want to create a situation where contrived information might have to be entered in order to save the record. |

After the report has been saved, the employee’s masked SSN (with the last four digits), an asterisk, and a counter to indicate the number of injuries the person has reported will be displayed in the window’s title bar. For example, “XXX-XX-8987*0004” is the employee’s fourth report of injury.

At this time, the Print buttons have been activated. The EDI Export feature is also available. These topics are covered separately.

The ATS Diary and Notes features may be accessed using the associated toolbar buttons. Please refer to the Claims chapter for details on using the Notes feature. The Diary is covered in a separate chapter in this manual.

The New button on the toolbar or <Alt>+N will display the Select Employee screen so you can create a new report without returning to the Console or Result List.

The Open button on the toolbar or <Alt>+O will display the Select FROI criteria so you can look up an existing Report of Injury without returning to the Console or Result List. The search criteria screen is the same as in the snapshot shown below.

Authorized users may view and/or edit Reports of Injury. The Selected FROIs menu item opens the Employer’s Report Search Criteria page that provides you with a wide variety of search options.

Figure 4‑10: Employer’s Report Search Criteria

Figure 4‑10: Employer’s Report Search Criteria

The following list shows employees whose last names start with the letter “S” and have filed a report for an injury that occurred between January 1, 2015 and December 31, 2015.

Figure 4‑11: Employer’s Report Result List

Figure 4‑11: Employer’s Report Result List

Note that if the Region feature has been implemented and Region View has been set in your user record, you will only be able to see a list of employees who have filed a Report of Injury in your assigned region(s).

Other menu options provide you with additional ways of looking for First Reports you have created.

They are:

|

Menu Option |

Function |

|

Recent |

Lists the First Reports completed in the last seven days. |

|

Unpromoted |

Lists the First Reports that have not been promoted to a claim. All but three have not been promoted on the above list, |

|

Promoted |

Lists the First Reports that have been promoted. Note the blue arrow is used to identify the promoted claim. |

|

All |

Lists all the First Reports with the most recent at the top of the list. |

Once you have selected the desired report, the program will display the record so the required changes may be made.

All the operations covered in the next sections can be performed as the report is created. With the exception of changing the State of Jurisdiction, which can be done at any time, the features will become available after the Employer Report is saved.

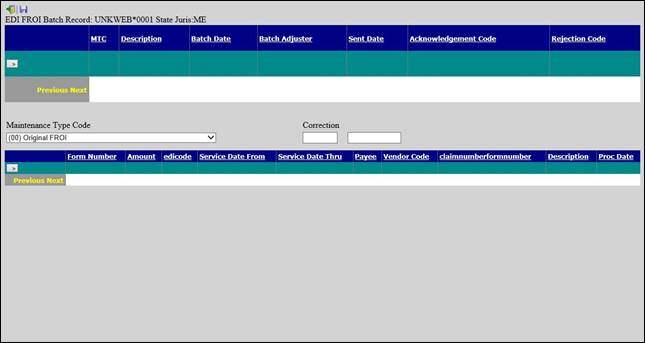

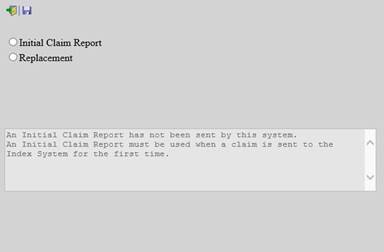

After saving the Employer’s Report, the EDI Batch menu option may be used to write selected data to a text file for export purposes. This dialog will appear so you can indicate the type of report you wish to send. The data will vary depending on which report (MTC) code is chosen.

Figure 4‑12: Employer’s Report EDI Batch Dialog

Figure 4‑12: Employer’s Report EDI Batch Dialog

The EDI process varies by state. Please refer to the separate EDI Export Utility document for details.

Many of the incidents that are reported never result in a claim action. If the employee does file a claim, the report may be promoted to claim status, so the pertinent data does not have to be retyped.

To promote an Employer’s Report of Injury to a claim use the Promote button after the report has been saved.

The program will:

1. Attach a policy (optional) and assign a claim number.

If the Policy module

is in use, there must be a policy that covers the Injury Date.

The program will check the From/Thru Dates for the policies and display a

message if one does not exist. Otherwise, select a policy from the list of

those that are available.

The program will automatically assign a claim number based

on the value of the Next Claim Number,

set using the Application Parameters page. If the Next Claim Number field contains

a number (not all zeroes), the program will assign it to the claim. Otherwise,

the program will use the Fiscal Year from the client’s record and the Injury

Date in

the employer’s report to determine which year code to use at the beginning of

the claim number. For example, if the Fiscal Year is “0701” and the Injury Date

is “09/01/2010”, the claim number will start with “11”.

Retired people can develop an illness such as hearing loss and asbestosis

related to the work they did. If that situation exists in your company, you may

choose to base the first two digits of the claim number on

the Open Date instead

of the Injury Date by

entering “OPEN” in the Next Claim Number field.

If policies are used, the first two digits of the number may be overwritten by

the policy’s Claim Number Prefix,

if one exists.

2. Create a claim with the pertinent information from the Employer’s Report. The program will transfer any relevant information to the new claim.

3. Write the claim number(s) on the Summary section of the report along with a check in the Promote to Claim field. Also display the new claim number in the title bar.

4. A warning message will appear if there is already a claim for the employee with the same date of injury.

|

|

All reports are promoted with a Claim Type of “N” for notation. The claims adjuster will need to decide whether the claim is a medical or indemnity case and update the Claim Type accordingly. |

This chapter describes the ATS features that are provided to help you manage claims as easily and efficiently as possible. Since keeping notes is an integral part of the job, this feature is also covered in this chapter.

Users with the appropriate access rights may use the New Claim item from a menu or click the New button on a Claim Result List to begin entry.

The system will first ask you to select an employee. Entering a last name that starts with “smith” will generate a list of employees with names like Smith, Smithy, Smithies, and Smithers. A first name or any of the other options may be entered to limit the choice list.

Figure 5‑1: Claim Search Criteria

Figure 5‑1: Claim Search Criteria

A record for the employee must exist before you can enter a claim. If one cannot be found, click New. When you Save and Close the Employee data entry page, you will be automatically returned to the Claims page and asked for the State of Jurisdiction for the claim.

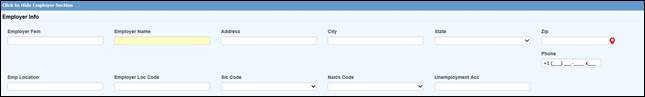

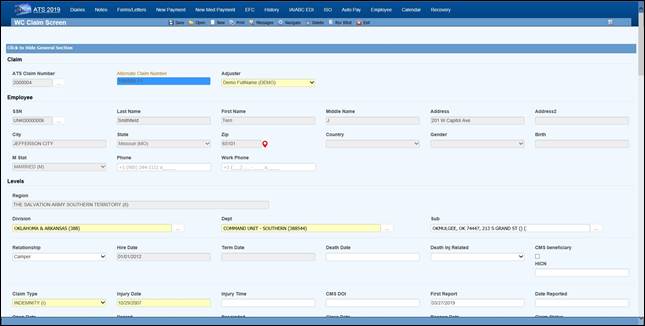

Click the Select button and the Claim data input page will appear. The screen shown below is the standard one provided by ATS. It contains all of the fields necessary to submit subsequent Reports of Injury to the State of Jurisdiction for both IAIABC Release 1 and 3.

The required fields appear in yellow by default. A system administrator may have set others as required. The default labels for the levels in your company’s hierarchy are Division, Dept and Sub. Those on your screen have probably been changed using the Application Parameters page.

Figure 5‑3: Claim Page – General Section (New)

Figure 5‑3: Claim Page – General Section (New)

|

|

All of the information displayed above was taken from the employee’s record. The personal information may not be edited from within the claim. If you need to make a change, click the Ellipsis … button next to the Last Name. |

It is important to note that the name the employee is known as in the ATS system may not be the person’s legal name. If that is the case, be sure to enter the name as known by the Social Security Administration in the employee record when the claim will be submitted to the CMS.

The fields in the General section that are not read from the employee’s record are described as follows.

|

Field Name |

Description |

|

Adjuster |

The user entering the claim is assigned as the adjuster by default. |

|

Claim Type |

Valid claim types are indemnity, medical, first aid which is treated as a medical claim on most reports, and notation which may be used to track an incident that has not become a claim. (Notations are not included in the standard ATS reports.) If there are indemnity reserves, the claim type will be changed to “INDEMNITY” when the claim is saved. |

|

Injury Date |

The date the injury or illness occurred is required. A warning is displayed if the date is over six months ago. When there is an existing claim for that date, review the pertinent information on the other claim to determine whether you are entering a duplicate claim. If the Policy module is in use, the program will search for one that covers the fiscal year in which the injury occurred. When the Administer-Configuration- Module Parameters menu has been used to enter a Policy Form, but the Policy Format field is empty, the program will search for a policy for a specific level, starting with the employee’s level 3 through 1, that covers the date the injury occurred (e.g. L101-2010). If a policy is not found for a level, the program will attach the first one it finds that covers the date. The Tools-Policy menu may be used to select a different one if necessary. The following Policy Formats may also have been used to specify which policy should be assigned to the claim: 1. @YR-L1 or @L1-YR: Searches for a policy for the specified year and level 1 (e.g. 2010-L101). 2. @ST-YR<L#: Uses the state code from the specified level (1 thru 3) and the year to search for a policy (e.g. FL-2010). 3. @ST-YR: Uses the code for the state of jurisdiction and the year to search for a policy. When a policy is found, the program will display the code in the window’s title bar and write the Deductible on the Financial page. If a policy is not found, a message will appear to indicate that the claim cannot be saved. |

|

Injury Time |

The (military) time the injury occurred in an HHMM format. This data is not required, but if it is entered a special claim analysis may be run from the Reports-Statistical menu. |

|

CMS Date of Injury |

The CMS expects the date of accident or the first exposure, ingestion, or implant. This may not be the date after which you are legally responsible. The CMS needs the actual date for any recovery claims. An approximate date is OK as long as it’s before the person’s date of entitlement to Medicare. If this field is empty, the program will automatically export the Injury Date. |

|

First Report |

The date the employer submitted the First Report of Injury. |

|

Report Date |

The date the employer was notified of the injury. This is usually referred to as the knowledge date. |

|

Death Date |

The date of death should be entered when relevant. Note that in fatality cases, we recommend that the employee’s beneficiary be set up as a dependent to facilitate the payment process. |

|

Cause of Death |

Indicate if the death was due to the injury, not related to the injury or unknown. |

|

Full Denial Date |

The date the claim was denied. This date is required when submitting a SROI for a full denial to the state. |

|

Denial Rescinded |

The date the denial was rescinded. |

|

Open Date |

The date the claim was opened is a required field. By default, the program will enter the current date. |

|

Closed Date |

The date the claim is closed. Refer to the Closing a Claim section for details on using this feature and how the reserves are affected. |

|

Reopen Date |

A closed claim may be reopened by deleting the Closed Date and saving the record. The current date will automatically be displayed as the Reopened Date. |

|

Start TD |

The program will determine the date of compensation from the first indemnity or rehab payment where the Grouper contains TD. The date will be adjusted if the payment is voided later. This date cannot be edited as it may be used in determining the number of lost days to report on the OSHA log. If you plan on entering TD payments manually instead of using the AutoPay module, the Administer-Configuration-Diary/Scan menu may be used to set up diaries to let the adjuster know when the payments are due. |

|

Stop TD |

The date temporary disability benefits end. |

|

Start PD |

The date of the first indemnity payment where the Grouper contains “PD”. The date will be adjusted if the payment is voided later. If PD payments are issued manually, the Diary Scan utility may be used to set up diaries to notify the adjuster when they are due. |

|

Stop PD |

The date permanent disability benefits end. |

|

Dependents |

The number of dependents added to the claim with the Tools-Dependents menu is displayed for informational purposes. Since this feature is used in states where dependents affect the benefit rate, the Benefits dialog will appear whenever this number changes so the rate may be adjusted accordingly. |

|

Basic Pay |

The employee’s salary without any fringe benefits. |

|

Average Weekly Wage

|

The program will calculate and display the average weekly wage based on the information in the employee's record. The Wage View flag may have been set with the Administer-Configuration- Module Parameters menu to hide either the wage for all claims or all except for indemnity. |

|

Wage Effective |

The date the specified wage became effective. This may be a required field when submitting a SROI in IAIABC Release 3. |

|

Benefit Type |

This value determines which rate table is used to calculate the benefit. Typically, the choices are TD (temporary disability), PD (permanent disability) or VR (vocational rehabilitation), but others may be available depending on the state of jurisdiction. If blank, TD benefits are calculated by default. Note that this field is required in order to use the auto feature when making a new payment. |

|

Benefit |

The weekly comp benefit rate for the state of jurisdiction may be entered manually or calculated by clicking the button to display the Benefit Calculator. Items such as the number of dependents entered with the Tools- Dependents menu, Other Income, the COLA amount, and the Benefit Adjustment are taken into consideration depending on the state’s guidelines. (See the Benefit Type description for more information.) In some states such as Virginia, a COLA

Requested box will appear in the top, right-hand corner. If the box is

checked to indicate that the employee wants COLA to be included in the benefit

payments, you may redisplay the dialog to see the date it was requested by

clicking the Ellipsis button. The following illustrates how the calculations are made: Original Weekly Amt = Weekly Wage x Benefit rate 587.48 = 766.28 x 76.667 Final Weekly Amt = Original Weekly Amt x Increase Multiple 613.92= 587.48 x 1.048 Weekly Increase = Final Weekly Amt - Original Weekly Amt 26.44 = 625.68 - 587.48 |

|

Alternate Claim Number |

When you save a claim for which auto payments have been scheduled and the benefit rate has been adjusted, you will be asked if those payments should be changed. If so, use the Tools-AutoPay option and adjust the amount. When the state’s benefit rates change, you may run the BENFITUP program to update the claim and payments scheduled with AutoPay accordingly. This field may contain a claim number that was used in a prior workers' compensation package. ATS refers to it as the alternate claim number which is available for lookup purposes. |

|

Medicare Beneficary |

A check will indicate that the employee is a Medicare beneficiary. Note that this box may be checked while processing a Query Response from the CMS. |

|

HICN |

Medicare’s health insurance claim number. |

|

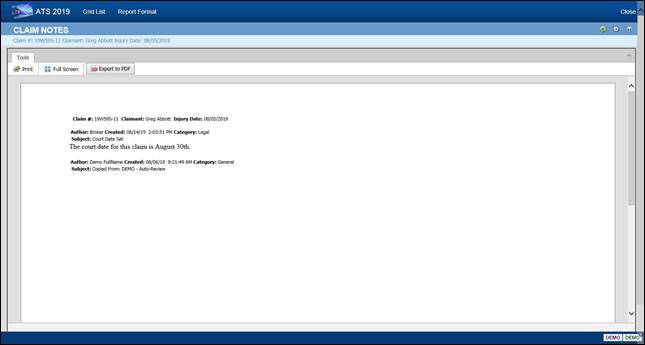

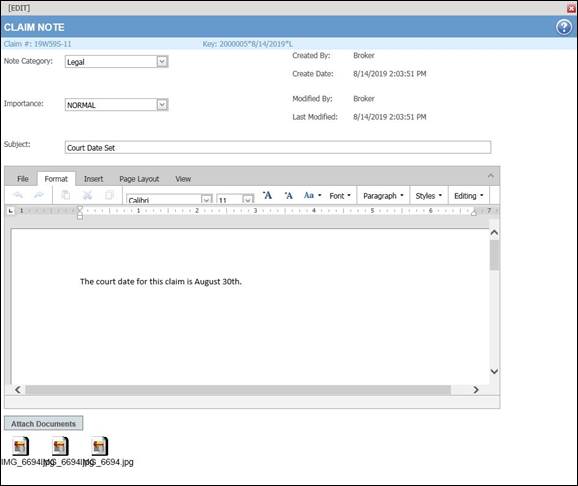

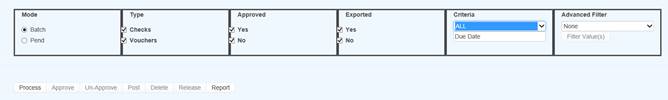

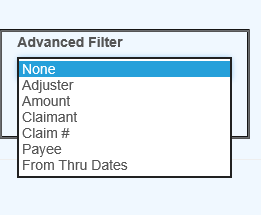

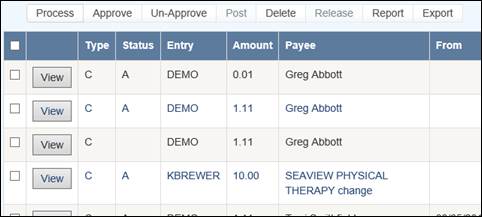

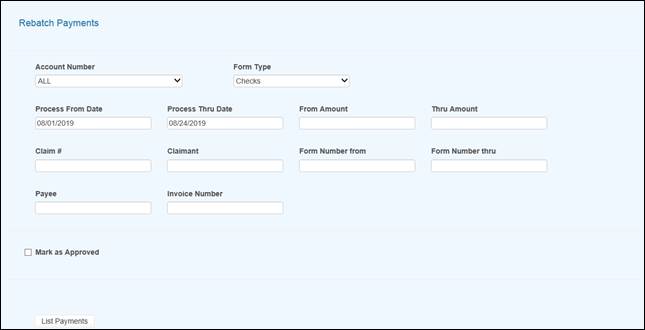

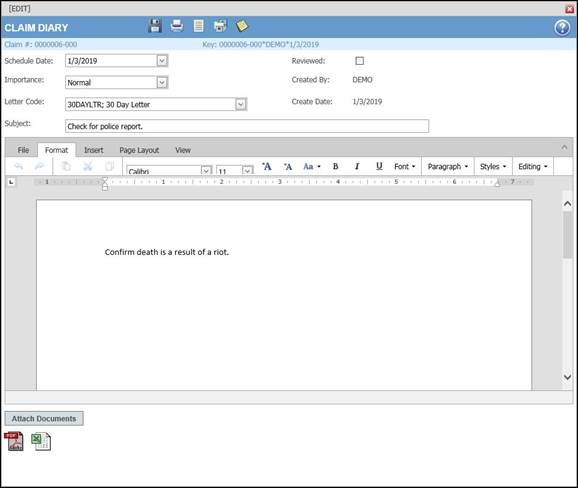

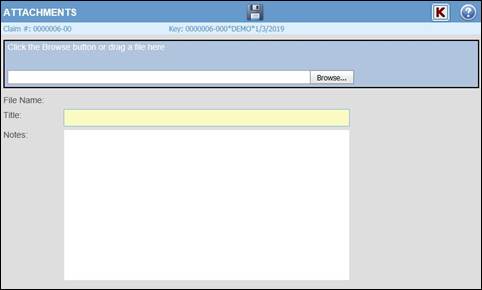

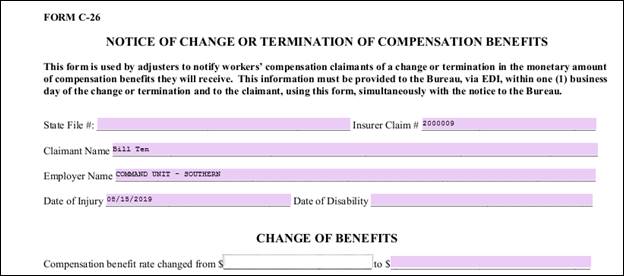

ORM Assumed |