Employees

The employee must have a record in the ATS System before a claim or an employer’s report of injury can be entered for the individual. The Employee program is available after selecting the Explore menu and clicking the Employee tab on the Worker’s Compensation menu.

Note that if your company has another software package that tracks employee information, a custom interface may be provided to import relevant data into the ATS System in order to save time and ensure that the data is accurate.

Entering a New Record

![]() Users

with appropriate access rights may enter employee records. You can use the New Employee item on a menu or the Open button on

the Employee

List to open the Employee data input page.

Users

with appropriate access rights may enter employee records. You can use the New Employee item on a menu or the Open button on

the Employee

List to open the Employee data input page.

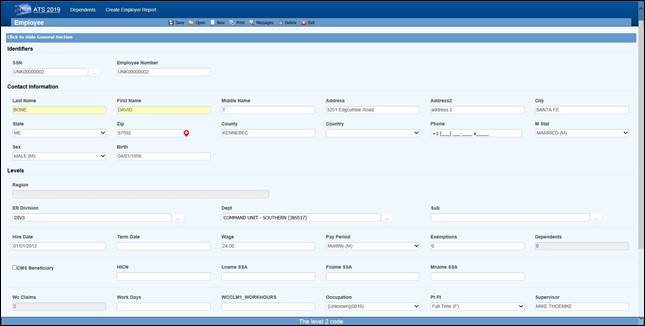

The standard screen used to track employee information is shown below with a sample record. Since the ATS System allows screens to be tailored to meet your organization’s requirements, your screen may look slightly different.

Note the fields related to the direct deposit feature will be hidden unless the user has the authority to use this feature.

Figure 2‑1: Employee Data

Input Page

Figure 2‑1: Employee Data

Input Page

The individual fields on the form are described as follows. Note that as soon as you enter the SSN, the program will search for an existing record with that SSN and display “Processing” at the top of the screen. If one is found, that record will be displayed.

|

Field Name |

Description |

|

SSN |

This is a required field. New employees will automatically be assigned a number such

as UNK00000028. When you type over this number, the program will insert

dashes if necessary, check to see if a record with that SSN already exists and, if so, display it on the

screen. If you are not sure of the SSN, we recommend that

you use the “UNK” number and edit the record when you have the

information. Any existing claims will

be updated when the record is saved. Note

that during a data conversion, a “UNK” number is assigned when the SSN is missing or invalid. This feature makes it

easy to find the records that need to be updated. |

|

Last Name |

The

employee’s first and last names

are required. This should be the name the person is known as. There are other

fields for their legal name. |

|

First Name |

If

a person changes his or her name, use the AKA feature to keep track of the previous

name(s) so the claim and employee records can be looked up by either one. For

details, refer to the AKA section. Note that is feature is in development so

it may not be available in your current version. |

|

Middle |

A

middle initial if any. |

|

Address |

Enter

the address and the zip code. The program will automatically fill in the

correct city, county, and state if the zip code is in the United States. |

|

Phone |

Phone

numbers entered as 10 digits such as 4101234567 will be displayed as 1+ (410)

123-4567 where the “1+” is the international dialing code for the United

States. |

|

Birth Date |

The

employee’s date of birth. Enter the date in

an MMDDYYYY format. The program will insert the slashes. |

|

Sex |

The

employee’s gender. |

|

Marital Status |

The

employee’s marital status may

be selected from the drop-down list or entered using the appropriate code

where M=married, S=single, D=divorced, and W=widowed. |

|

Hire Date |

The

date of employment. |

|

Term Date |

The

employee’s termination date

if any. |

|

Last Transaction |

The

ATS system will track changes made to fields in the employee record if a system administer has set them

up as transactional. The program will display the last date one of the

transactional fields was changed for informational purposes. |

|

Wage |

The

employee’s wage during the

specified pay period. |

|

Pay Period |

The employee’s pay cycle may be

selected from the drop-down list or entered using the appropriate code where

H=hourly, D=daily, W=weekly, B=bi- weekly, M=monthly, and A=annual. Note:

When a claim or First Report of Injury is entered for the employee, the program will

calculate the average weekly wage and write it into the record so it can be

used to determine the employee’s benefit rate. |

|

Exemptions |

The

number of exemptions is an optional field used to calculate any taxes withheld when

making benefit payments in the A&S Disability product. (The same employee screen is used for both.) |

|

Dependents |

The ATS System will update this field

and display the total number of

dependents for the employee as records are added and/or removed. The

number may not be edited. (See the Dependents section.) Note: The Dependents module may be used when 1. The employee's wages have been

garnished and a lien needs to be set up (e.g. child

support). 2. The number of dependents affects the

Workers' Comp benefit rate. 3. There is an additional claimant for a

Medicare beneficiary who is deceased. |

|

# Claims |

The

program will increment this value as claims are entered for the employee. This field may not

be edited. |

|

CMS Beneficiary |

A check in this box indicates that the

employee is a Medicare beneficiary. Normally,

the check is entered by the program that processes the CMS Query Response file. |

|

HICN |

The

Medicare health insurance claim number will be filled in with the data in the CMS Query Response file. |

|

Last Name (SSA) First Name (SSA) Middle Initial |

The

employee’s name as known by

the Social Security Administration if

it’s different than the one used in the rest of the Worker’s

Compensation system. If the employee is a Medicare beneficiary, this name will be sent when

submitting a report to the CMS (Centers for Medicare and Medicaid

Services). |

|

Division Dept Sub |

The levels that indicate where the employee works within the company’s hierarchy are

called Division, Dept, and Sub by default. These labels have probably been

changed on your screen. Levels may be entered in the following ways

depending on how your system has been set up: 1.

Pressing the Ellipsis button in any level field will display a list of

all the available entries. This is the default. 2.

If the Level 1 and 2 fields are blank, you may be able to enter a Level 3 to

have the program automatically fill in the associated levels. |

|

Occupation |

The

employee’s occupation. Press

the Ellipsis button for a list of choices. |

|

Employment Type |

The

employee’s status such as

full-time and part-time. Press the Ellipsis button for a list of choices. |

|

Employee # |

The number assigned to the employee by the company. It may be entered in the

Employee Selection dialog to look up a record. This

ID number may be used to ‘identify’ the employee in certain cases where the SSN may not be displayed for privacy reasons. |

|

Supervisor |

The

name of the employee’s supervisor. |

|

Notes |

A

short note pertaining to the employee. For example,

“Employee hired for project number J3466”. |

|

Direct Deposit |

Direct deposit is an optional, add-on

module. A check in this box indicates that the employee wants his/her benefit payments deposited

directly in the bank. Depending on the user’s security settings, these fields

may not be visible. |

|

Routing Number |

The bank’s routing number. |

|

Bank Account |

The employee’s bank account

number. |

Saving a New Record

The program will display a message indicating that the record has been saved successfully. At that time, the employee’s name and SSN or ID will be displayed in the window’s title bar. If you have skipped over any of the required fields, the “Required fields missing” message will appear. Enter the data. When you are done, save the record again.

Editing an Existing Record

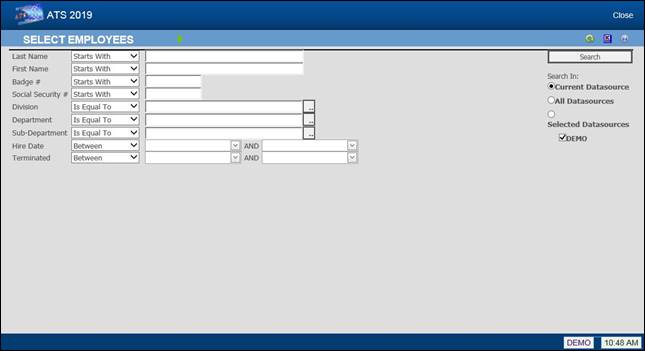

The Employee menu provides a number of options to find the record you want to view and/or modify. The first option, the Selected Employees search, lists a variety of criteria you can use to quickly find the record. The standard list is shown below. The criteria on your system may be different.

Figure 2‑2: Employee Search Criteria

Figure 2‑2: Employee Search Criteria

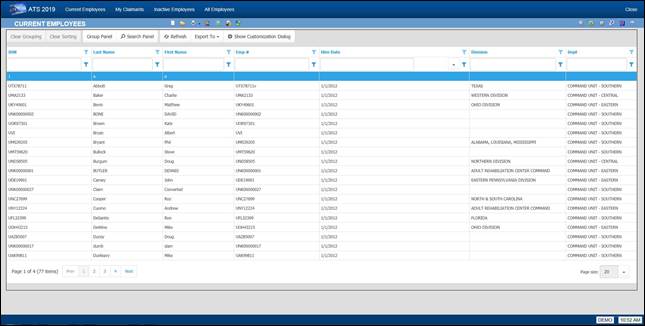

There are other ways to look up records. The options are as follows:

|

Menu |

Function |

|

Claimants |

Lists

all claimants with claims where the Adjuster is the current user. Current Employees Lists

all employees that are currently working for the organization. |

|

Current

Employees |

Lists

all employees that currently work for the organization. |

|

Inactive

Employees |

Lists

all employees that have left the organization (i.e. a Termination Date

exists). |

|

All

Employees |

Lists all

employees whether or

not they are

currently working for

the organization. |

Figure 2‑3: Employee Search Result

List

Figure 2‑3: Employee Search Result

List

Note that if the Region by Level feature has been implemented and Region View has been set, you will only be able to see a list of the employees in your specific region.

However you find the employee, make the desired changes. When you are done, save the record and exit the program.

If a system administrator has set the Query Employee Changes flag using the Module Parameters screen, the program will check the employee’s name, address, phone, supervisor, birth, and/or termination date. If any information has changed, you will be asked if the individual’s claims and reports of injury should be updated.

|

|

When

an employee’s social security number is changed, all the appropriate tables

will be updated automatically. |

Adding an Employer’s Report of Injury or a Claim

![]() Some

employees sustain a number of injuries while they work for a company. If you need to enter a report for a person

that already has an existing employee record, we recommend that you edit the record

to make sure that the information is current. When you are finished, you may

use the New Employer’s Report button to continue.

Some

employees sustain a number of injuries while they work for a company. If you need to enter a report for a person

that already has an existing employee record, we recommend that you edit the record

to make sure that the information is current. When you are finished, you may

use the New Employer’s Report button to continue.

![]() The

same suggestion applies when you need to enter a claim. When you are finished

verifying that the employee’s data is up to date, you may

use the special New Claim button to continue.

The

same suggestion applies when you need to enter a claim. When you are finished

verifying that the employee’s data is up to date, you may

use the special New Claim button to continue.

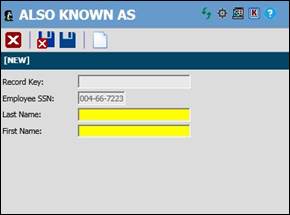

Adding an AKA Name

People are often known by more than one name. The name in the employee’s record and their open claim(s) should be the same as it is the one that will appear on all payments issued to the employee.

Any other name the employee uses should be entered as an alias using the AKA feature. For example, a woman often takes her husband’s name when she gets married. In that case, you should enter her new name in the Last Name field and her maiden name as the alias. After that you will be able to find the employee and the associated claim records using either name.

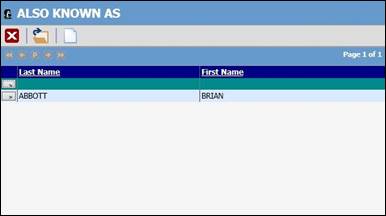

![]() The

Employee data entry

page contains an AKA button.

Clicking the button opens the Also Known As list. The list

shows all of the AKA entries for the employee.

The

Employee data entry

page contains an AKA button.

Clicking the button opens the Also Known As list. The list

shows all of the AKA entries for the employee.

Figure 2‑4: Employee Also Known As List

Click the new button to open the AKA data input dialog. Enter the alias and save the record. Now you can search by both current and alias names.

Figure 2‑5: Employee Also Known As Dialog

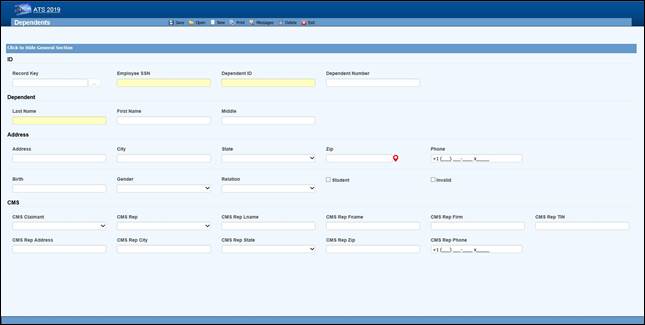

Entering a New Dependent

There are a number of reasons for creating dependent records. Some of them are:

1. The employee was a Medicare beneficiary and is now deceased. Dependent records must be entered for any “Additional Claimants” that need to be submitted to the CMS (Centers for Medicare and Medicaid Services).

2. The individual wants to attach a lien to the employee’s payments or be considered when calculating the benefit amount for a claim.

3. The individual is the employee’s beneficiary and entering the person as a dependent will simplify the payment process for a fatality claim.

![]() To

enter a new record or modify an existing one, click the Dependents button to display the Dependents

List.

To

enter a new record or modify an existing one, click the Dependents button to display the Dependents

List.

Figure 2‑6: Employee Dependent List

Click on the new button. The following screen will appear. Enter all pertinent data and then click Save. The dependent record is now available to use.

Figure 2‑7: Employee Dependent Data Input

Figure 2‑7: Employee Dependent Data Input

The fields on this screen are described as follows:

|

Field Name |

Description |

|

SSN |

A

valid SSN should be entered for the individual. |

|

Last Name First Name M.I |

The complete name if the dependent is an individual. If the dependent is an estate, enter “The

Estate of <employee>”, “the Family of

<employee>” or “The Trust of <employee” depending on the entry in

the Relationship field. In any case, leave the other name

fields empty. |

|

Address |

The

individual’s address, city, state, and zip code |

|

Phone |

The

individual’s phone number. |

|

Birth

Date |

The

individual’s birth date is important if the state of jurisdiction for the employee’s claim has an age

limit for tacking deductions for dependents (when calculating the benefit

rate). |

|

Gender |

The

individual’s gender if relevant. |

|

Relationship |

The dependent’s relationship to

the employee. The valid options are: F

= Family Member, Individual Name Provided O

= Other, Individual Name Provided X

= Estate, Entity Name Provided (e.g. "The Estate of John Doe") Y

= Family, Entity Name Provided (e.g. "The Family of John Doe") Z

= Other, Entity Name Provided (e.g. "The Trust of John Doe") |

|

Student |

A

check indicates that this individual is a student. |

|

100% Dependent |

A

check indicates that the dependent is to continue being on a claim’s eligible

list regardless of age. |

|

Additional CMS Claimant |

This

number from C1 to C4 must exist in the record in order for the dependent’s data to be

submitted to the CMS. |

|

Type

of Rep |

The type of representative for the dependent. Valid choices are: ·

Guardian/ Conservator ·

Attorney ·

Power of Attorney ·

Other |

|

Name Address... |

The

rest of the fields for the representative are self-explanatory. |

Saving a new record (or deleting an existing one) will update the # of Dependents for the associated employee.