Operators with the appropriate authority can

handle any financial operation regarding a claim. The transactions will be

covered in the following order:

- Making General Payments

- Entering Recoveries

- Scheduling Auto Payments

- Voiding Payments

- Changing Reserves

- Editing Batched Payments

- Issuing Credits

- Using the Bill Review Module

If you are in Explore, you can make payments

without actually opening the claim. Simply select the

desired claim and click the General Payments button. The button is also

available if you are already editing a claim and want to make a payment.

Knowing that some bills arrive after a claim

has been closed, the ATS System has a special Stair Step Reserves feature that

may be set so you can make a payment without having to reopen the claim.

The future reserves are always displayed for

your convenience, but the bank account number and the balance in the trust will

not appear if you are creating vouchers. (The number of reserve categories and

their names will depend on how your ATS System has been set up.)

On the upper right side of the screen, you’ll

see a special field that displays the claim number with an ellipsis button to

the right. This field allows you to

enter multiple payments rapidly by saving the payment, typing the next claim

number in this field, entering the next payment and saving. The ellipsis button provides a claim search

function if you don’t have the claim number available.

The example above shows an indemnity payment

that was set up by simply clicking the Ellipsis button next to the amount.

Refer to the fields below for information on this feature. The fields are

described as follows:

|

Field Name |

Description |

|

Pay

Type |

The

payment type is either voucher or check. Note that checks debit the trust

fund (bank account) balance, but vouchers do not. The record shown

above will produce a voucher so the number of the trust fund account and the

balance in the account are not displayed at the bottom of the screen. This information

will appear if you produce checks. |

|

Amount |

The

amount to be paid. A special feature allows you to make an auto indemnity

payment by pressing the Ellipsis button. The program will automatically

display the amount, the employee’s name and address, the default From/Thru dates and “1” in the reserve category field. A

default pay code may also appear. (The defaults are set with the

Administer-Configuration-Application Parameters menu.) If

there is a negative account balance, you may get a "Bank Balance

Insufficient" message depending on a setting entered with the

Administer-Configuration- Module Parameters menu. When this message appears,

the amount will be reset to zero. Another setting may

allow you to enter a batched payment with a negative balance. Attempting to

print a payment or enter a notation will display the message "You may

only batch this payment due to low funds". If you

are using the Stair Step Reserves feature set with the Administer-

Configuration-Application Parameters menu, the reserves will automatically be

increased to cover the payment. |

|

Vendor

Code |

If the

payee is any of the following, enter the code and the program will fill in

the information from the claim. C claimant D dependent (a choice list will

appear) CA claimant’s attorney DA defense attorney P medical provider Otherwise,

enter the vendor code including the asterisk and location or press the

Ellipsis button to select a vendor from the table. |

|

From/Thru

Periods |

The

dates for up to three billing/payment periods may be entered. Pressing the

Ellipsis button next to the amount will display a period based on the Thru

date for the last indemnity payment and whether the Benefit type for the

claim is “TD” or “PD”. By default, these are two week

periods, but the values may be changed with the

Administer-Configuration-Application Parameters menu. If the From/Thru

period is changed for an auto calculated indemnity payment, the program will

display a message explaining how the benefit amount was recalculated and ask

if the amount should be adjusted. When a future date

has been entered, the program will display “Warning: Date entered is greater

than today’s date” on the title bar. Depending on your check printing

schedule, you may need to enter future dates. In that case, ignore the

warning message when it appears. Back

and post-dating payments may be allowed depending on the settings entered

with the Administer-Configuration-Module Parameters menu. Note that it is

very important to be able to back-date a notated payment that was printed on

a prior date. The post-dating feature is also useful since it allows payments

to be entered for printing sometime in the future when you may or may not be

in the office (e.g, on vacation). |

|

Reserve

Cat |

The

code for the reserve category that the payment will be drawn against. If the

payee is a vendor with a default reserve category and pay code, these values

will be displayed on the screen automatically, but they can be modified. |

|

Wage

Continued |

If the

Wage Continued flag is set in the claim, the message “Warning - Wage

Continued” will appear to remind you that an indemnity payment is being made

to an employee who is receiving his or her salary in lieu of worker’s comp

benefits. A

message will also be displayed when auto payments have been scheduled for

that period. Unless the Negative

Reserves value has been set to “Y” with the Administer- Configuration-Module

Parameters menu, the amount to be paid may not be more than the future

reserves for the specified category. If the amount is higher, the program

will read the Stair Step Reserves value set with the Administer-

Configuration-Application Parameters menu. If the value is “N”, you will be

given an opportunity to edit the reserves and increase the amount so the

payment may be issued. For example, “Futures insufficient by 286.00. (Use the

Change Reserves icon on the tool bar.” If Stair Step

Reserves contains an “A”, the incurred amount will be automatically increased

by the amount of the payment. A value of “C” will increase the reserves for

closed claims only. In both cases, the future reserves will still be zero

after making the payment. Refer

to the Editing Reserves section in this chapter for more information on this

process. |

|

Payment

Code |

The

payment or cost center code for the specified reserve category. Default codes

for auto TD or PD indemnity payments may be set with the Administer-

Configuration-Application Parameters menu. |

|

OSHA

Days |

When making a payment

to the employee from reserve category 1 or 3 (indemnity or rehab), the

program will check the contents of the Grouper field in the specified Payment

Code. If this value contains “TD”, then the From/Thru

days are used to calculate the OSHA Days based on a calendar week. This value

will be displayed on the screen and added to the existing values in the claim

record. There

will be times when an employee performs another job or the same job with

restrictions due to an injury or illness. If the job pays less than the

usual, the employee should get a comp payment to make up the difference. In

that case, it is very important that the temporary disability payment is made

with a pay code that contains I08 (wage loss) in the report category so the

days in the From/Thru period will be ignored when

reporting to OSHA. If this feature is not used, the days would be counted as

lost time when the employee is really at work. |

|

Note |

An

optional note or memo to be displayed on the check/voucher. |

|

Status |

There

are three choices: 1.

Batch the payment record so that it can be printed later

or exported with the Accounting Interface module. 2.

Notate payments that were issued without using the ATS

System. For example, suppose a check is lost. After voiding the original

payment, enter a notated payment with the same date. 3.

Click the Print button if you want to print the payment

immediately. |

|

Form

Number Process

Date |

When

the Status is Print or Notate, the program will make these fields available

and fill in the form number and current date which can be changed if

necessary. This is a handy

feature when the original payment was incorrect (e.g. has the wrong reserve

category) and has to be voided. You can’t batch

another payment because the check has already been cashed. In this case, you

will need to enter a notated payment Note

that the next check number is stored in the bank information entered with the

Trust Fund menu while the voucher number is in the client’s record. |

|

Due

Date |

The Due

Date field is available when the payment is to be batched. If there is no

specific date, leave the field empty so the payment will be included the next

time a batch is printed. Back

and post-dating payments may be allowed depending on the settings entered

with the Administer-Configuration-Module Parameters menu. Since the Print

Batch program asks for a due date, the post-dating feature allows you to

enter payments to be printed in the future. It is also important to be able

to back- date a notated payment that was printed on a prior date. |

|

Separate

Handling |

If

the Separate Handling box is checked, the payment will not be combined with

other payments to the same vendor. Checking this box also allows you to

inform the accounting department (when the Handle Return File option in the

Accounting Interface is used) that the check should be sent back to claims

for special handling before it is mailed. |

|

EDI

Late Reason |

Each

state requires that the initial indemnity payment is issued a specific number

of days after the date of injury. If this payment will be transmitted to the

state via EDI, then select a code to indicate why the payment is late.

Omitting the code may cause the state to reject the transaction. |

|

Invoice

Number |

The

invoice or reference number being paid, if any. |

At this point, the program will search for

possible duplicate payments for the same payee, reserve category, pay code and

from date. If one is found, the program will display all the details on the

other payment(s) so you can decide whether you should click Continue and save

the payment. Clicking Cancel will leave you in the payment screen without

saving the record the payment is over this amount, the program will display

“Over check limit. Record will be pended.” The payment will be pended until

someone with a higher limit releases it (to batch) with the Process- Edit Batch

menu.

In states such as Florida and South Carolina,

the MMI Date in the claim determines whether a $10 copayment can be applied to

a medical payment. A message will appear if the date has been reached. Click Yes to apply the $10. The No button will return to

the payment program. When you Save the record, the program will clear the

screen except for the payee. At this point, you can enter another payment to

the same or a different payee or exit the program.

The AutoPay module is included with the

standard ATS System so you may schedule payments to be made on a regular,

ongoing basis. This feature is available from the menu from within a claim or

from the Selected Claims list screen after selecting a claim.

The program displays the following screen. .

Depending on how the claim has been set up, the

following buttons may be used.

|

Button |

Function |

|

Edit |

Displays

the selected payment record for viewing and/or editing purposes. If the list

is empty, this button will be disabled. |

|

New |

Displays

a blank form so a new record may be entered. |

|

Auto

Setup |

Sets

up a new payment schedule automatically. This button will be disabled if

there is a Start TD or Start PD Date in the claim. |

|

Close |

Exits

to wherever you started, either the claim or the Selected Claim menu. |

There are two ways of scheduling new payments.

Each method will be covered in this section.

Using the Auto Setup of Compensation Button

The Auto Setup button is available for setting up the benefit

period. It will be enabled for indemnity claims that have a specific Benefit

Rate, but no benefit payments (i.e. the Start TD and Start PD Date fields are

both empty).

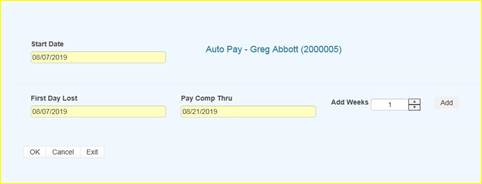

Selecting the button will prompt for the

compensation period. The First Day Lost will be displayed if the date exists in

the claim record. Enter the date when the period will end. It can always be

changed later. If you don’t know the exact date, add the number of weeks to be

paid and click the Pay Comp Thru field to update the ending date.

Click OK and the program will set up the

payment schedule as shown in the following example.

In addition to the information found in the

claim record, the program will search the various tables to find the default

values for the Pay Code, State Days, and Waiting Period when the Auto Setup of

Compensation feature is used. (All of the fields will be covered next.)

If the program finds all the required

information and the Pay Day value for the employer is set to something besides

any day, then the only thing left to do is save the record. Otherwise, the date

for the Next Check must be entered before the record can be saved.

Using the New Button to Schedule Payments

If you use the New button,

normally the information on the form will have to be entered manually. The

fields are described as follows:

|

Field Name |

Description |

|

Record

# |

The

default is “1” for the first payment schedule. Enter “2” to indicate a 2nd

one. A

total of nine records may exist at any one time. Records no longer appear on

the list after the last payment has been made. |

|

PMT

Type |

The

payment type

is either checks

or vouchers. If necessary, a

system administrator may change the default value. |

|

Payee

ID |

The

payee’s social security or federal ID number. Enter "C" if the

payee is the claimant, "D" for a dependent receiving alimony or

child support, or press the Ellipsis button for a

list of vendors. If

this is a fatality case, we recommend that you enter the individual who will

receive the death benefits as a dependent to make it easier to schedule

payments. |

|

Payee |

The

name of the payee will be filled in automatically after reading the social

security number or vendor code in the previous field. |

|

2nd

Payee |

The

name of a second payee if any. For example, if the employee's check needs to

go to a legal firm for disbursement, the c/o name should be entered here. |

|

Address,

City, State, Zip, Phone |

The

address and phone information will be filled in automatically after reading

the record with the specified social security or federal ID number. |

|

RSV

Cat |

The

reserve category to be used. The Auto Setup feature will enter “Indemnity” by

default. Press the Ellipsis button for a list of other categories that are

available on your system. |

|

Pay

Code |

The

payment or cost center code. Press the Ellipsis Button for a list of codes

that are available for the specified reserve category. If

the Auto Setup button is used, the program will use the Benefit Type code

specified in the claim record to look for the default code set up with the

Administer-Configure-Application Parameters menu. |

|

Rate |

The

employee’s benefit rate. If an amount has been entered in the claim record,

it will be displayed here automatically. (A benefit rate must have been

entered in the claim in order to use the Auto Setup feature.) |

|

Work

Comp From |

When

the Auto Setup of Compensation button is used, the program will calculate the

starting date based on the First Day Lost and the days in the state's waiting

period, otherwise it must be entered manually. In either case, the From Date

will be adjusted as payments are made. |

|

Work

Comp Thru |

The

day benefits should end. The program that batches the payments will generate

"Next to Last Payment" and "Last Payment" diaries to warn

the adjuster that the claim should be reviewed. This date may be modified if the payment

period needs to be shortened or extended. |

|

Wait

Period From/Thru |

When

the Auto Setup of Compensation button is used, the program automatically

calculates the From and Thru dates based on the Waiting Period and Before

Paid values in the record for the claim's state of jurisdiction. This

feature will not work correctly if the values in the state's record are

incorrect. If for some reason, you do not want the program to calculate the

waiting period payment, zero out the values for the state. |

|

Pay

Period |

The

Auto Setup feature will automatically enter “B” (bi-weekly) as the Pay

Period. Other

valid entries are “W” (weekly) and “M” (monthly). |

|

Benefit

Type |

The

benefit type from the claim record, either “TD” (temporary disability), “PD”

(permanent disability), or “VR” (vocational rehabilitation). |

|

PMT

Periods |

The

total number of payments to be made will be calculated after you have entered

the pay period and from/thru dates. This value can not

be modified. It will be updated automatically as payments are made. |

|

Original

From |

The

Comp Period From Date will be updated as payments

are made, but the original date is displayed here for your information. |

|

Next

Check |

The

date of the next payment. This date will appear as the first Batch On date on

the list of future payments. (See below for details.) |

|

Prior

Check |

The

date of the last payment that was batched. |

When the record is saved, the program will

check the claim to verify that there are sufficient

reserves to make the payments. If there aren’t, you will be prompted to

increase the reserves accordingly.

AutoPay creates the payment schedule and

displays it on the screen as it saves the record. This particular

example was created to batch the payments after the pay period (AutoPay

Mode set to A) and the employer’s Pay Day set to any day. (Refer to the Setup

Procedure in a later section.) The Next Check date is used as the first Batch

On date. This is the most typical configuration.

Note the first payment on the list is for the

waiting period. In the state of jurisdiction for the claim, there is a 14 day period before those days can be paid.

Typically, the Comp Thru Date does not fall at

the end of a pay period so the last payment is only for a few days. When that

happens, the program will check the Scheduled Hours in the claim record.

If there are no Scheduled Hours, AutoPay

assumes that the individual works a regular week and calculates the payment

accordingly. But, suppose the employee works Monday and Wednesday through

Saturday. (Work days are those which contain a value

in the Total field on the Scheduled Hours dialog.) If the Thru Date falls on a

Wednesday, the program will know that the employee does not work on Tuesday and

only pay for two lost days.

The program that batches the auto payments will

generate a diary to the adjuster when the next to the last and the last

payments are batched.

The Autobat program

must be run to batch payments according to their Batch On date. AUTO will be

stored as the user who processed the transaction. Although the reserves must be

sufficient to schedule the payments, the reserves may

have been used up since then.

Auto payments will always be batched because of

a possible late penalty. When the reserves are insufficient, the program checks

the Stair Step Reserves value entered with the Application Parameters. If it is either "Closed" or

"All", the reserves will be automatically increased to cover the

payment. Unless Negative Reserves has been set to “N”, the futures will become

negative. In any case, a diary will be sent to the adjuster.

Auto Batch logs may be viewed with the Image

Files menu. When appropriate, "Next to Last Payment" and "Last

Payment" entries will appear along with a diary telling the adjuster to

review the claim.

The number of OSHA Days in the claim is updated

as payments are batched against reserve categories 1 and 3 (indemnity and

rehab) for pay codes with “TD” in the Grouper field. This number is based on a

calendar week.

The system administrator must set up AutoPay so payment schedules are created to meet your particular

needs. When the record is saved, the program will check the Pay Day and AutoPay

Mode values as defined below.

|

Item |

Set In |

Value |

|

Pay

Day |

Employer’s

record |

Sunday

thru Saturday or Any Day |

|

AutoPay

Mode |

Application

Parameters |

Standard

(sets the first Print Date to the first Pay Day at the end of the pay period) After

(sets the first Print Date to the first pay day after the pay period ends) |

When the

Auto Setup of

Compensation feature is used and Pay Day is set to a specific day of the week,

the program will ignore the Next Check date, if one exists, and use the AutoPay

Mode to calculate it and the subsequent Print Dates (displayed with the List

option). Changing the Next Check date will have no effect.

The Reserve

Change button

will display the following dialog so the reserves for an open claim may be

changed depending on the permissions granted in your user’s profile. This

dialog also appears when the reserves must be increased in order to enter a

payment.

Before the modified reserves can be saved, a

Reserve Change reason must be selected using the drop-downs

on the right. These changes may be viewed later with the History module.

There are two types of reserve limits that may

be set in the ATS Security System: a Cumulative Limit

which is the total incurred entered per user that cannot be exceeded and a One

Time Limit which is the amount that may be entered during a session. (A session

ends after exiting the program.)

These limits may apply to the total reserves or

to individual reserve categories. For example, suppose the One Time Limit is

set to 25,000 and the Cumulative Limit is 50,000. Depending on the current

amount in the specified category, the change may or may not be allowed. Note

that the Cumulative Limit examples assume that prior changes to the incurred

were made by the same user.

One Time Limit=25,000 Cumulative Limit=50,000

Incurred in Claim Reserve

Change Allowed?

Example 1 15,000 25,000 YES

Example 2 35,000 25,000 NO

Example 3 45,000 10,000 NO

It is important to note that when both the

limits are zero or null, there is no limitation on the changes that may be

made. If the One Time Limit is set to 25,000 and the Cumulative Limit is zero,

the user may increase the reserves up to $25,000 a session regardless of the

current amount in the claim.

One Time Limit=25,000 Cumulative Limit=0

Incurred in Claim Reserve

Change Allowed?

Example 1 15,000 25,000 YES

Example 2 35,000 25,000 YES

Example 3 35,000 35,000 NO

Conversely, if the One Time Limit is set to

zero and the Cumulative Limit is 50,000, the reserves may be increased by any

amount until a total of $50,000.

One Time Limit=0 Cumulative Limit=50,000

Incurred in Claim Reserve

Change Allowed?

Example 1 15,000 25,000 YES

Example 2 35,000 15,000 YES

Example 3 5,000 50,000 NO

The program will automatically update the

future reserves and display the new totals as the incurred values are modified.

There may be times when you need to issue a

credit against a specific claim. The credit might be for a particular

payment when there was an overpayment. A credit may also be issued when

there has been money recovered and the amount should be subtracted from the

amount paid. In that case, there would be no prior payment involved.

Regardless, if the claim is closed and the futures are zero, they will remain

zero after the transaction has been made. Each of these type

of credits will be covered in this section.

Select the Payment History button if you need

to issue a credit for all or a part of a specific payment. The following screen

will appear with a list of the payments that have been made. The list may

include some existing credits where the form number ends with *R and a number.

Scroll through the list until you find the

payment you want. Then, select the

payment and click the Credit button. The program will display the Credit

screen along with the data from the original payment. Note the Status field. A

warning message will appear if you attempt to credit a payment that has been

voided.

The cursor will be positioned in the Credit

Date field so that you can modify the following items. Save the record to

complete the transaction.

|

Field Name |

Description |

|

Credit

Date - Time |

The

current date and time appear by default. |

|

Amount |

The

amount to credit may not exceed the amount of the original payment. If a

credit has already been applied, it will be subtracted from this value. |

|

Note |

The

note or

memo that appeared

on the original

payment is displayed. It may be

modified to indicate the reason for the credit. |

This option allows you to issue a credit for a

claim when there is no particular payment involved

(e.g. the credit applies to a group of payments). This feature should also be

used when the money recovered on a claim must be deducted from the amount paid.

In this case, the amount could not be entered as a recovery since these are

tracked separately in the ATS System.

After selecting the desired claim, pick the Credit (no check) button. The program will display

the same form used to issue standard credits, but the information has to be

entered manually since there is no payment record..

The fields on the form are described as

follows:

|

Field Name |

Description |

|

Vendor

Code |

If the payee is any of

the following, enter the code and the vendor code, name, and address will be

filled in with the information in the claim record.

If

the payee is someone else, press the Ellipsis button to search for the

vendor. |

|

Reserve

Cat |

The

code for the reserve category to be credited. |

|

Amount

PTD |

As

soon as the reserve category has been specified, the total amount paid for

that category will be displayed. |

|

Payment

Type |

The

type is either check or voucher. |

|

Credit

Date/Time |

Normally,

this data is not changed. |

|

Reason |

A

note explaining why the credit was issued. |

|

Credit

Amount |

The

amount to be credited may not exceed the amount paid. |

In the ATS System, recoveries are tracked

separately from payments, credits, and voids. The amount paid will not be

adjusted. Use the Credit menu when the money received must be deducted from the

amount paid against the claim.

The fields to be entered on the form are

described as follows:

|

Field Name |

Description |

|

Recovery

Amount |

The

amount recovered. A warning will be displayed if this amount is greater than

the amount paid. |

|

Vendor

Code |

The

code for the vendor making the payment. Press the Ellipsis button to search

the vendor records or enter “C” to display the Claimant’s information or

"S" to display the Recovery (Subro) Party

from the claim. In the latter case, no vendor code will appear because there

is none in the claim. |

|

Invoice

No./Date |

The

invoice or reference number and date. (optional) From/Thru The range of dates in

the period. (optional) |

|

Reserve

Category |

The

code for the category from which the recovery will be made. |

|

Recovery

Type |

The

code indicating the type of recovery is normally a required field. |

|

Note |

An

optional note regarding the recovery. |

|

Recovery

Date - Time |

The

current date and time may be modified if necessary. |

|

Update

Bank |

A

check will update the bank balance (i.e. the client’s trust fund). This value

has no effect if you use the ATS System to issue vouchers, not checks. |

Menu options are available so that you may void

a payment or recovery. Typically, that is necessary when a transaction was

entered incorrectly.

Whether the payment was entered for the wrong

reserve category and pay code or it was lost in the mail, the original

transaction should be voided and re-entered.. This is

done by selecting the History button . The following

screen will appear with a list of the payments that have been made.

Scroll through the list until you find the

payment you want. Then, select the

payment and click the Void button. The program will display the Void

screen along with the data from the original payment.

The following screen is used to void payments.

The only fields that may be edited are the Void Date, Reason, and the Type.

Simply save the record to void the payment.

If the claim is closed and the futures are zero, they will remain zero

after the transaction has been voided.

Note:

1. Voiding a benefit payment may affect the Start

TD or Start PD dates in the claim. If the first payment is voided, the new

starting date will be the From Date in the second payment.

2. If the claim is closed and the futures are

zero, they will remain zero after the transaction has been voided.

Suppose you receive money on a claim and enter

it as a recovery before realizing it should have been a credit so the amount

would have been deducted from the paid. In that case, you will need to void the

original transaction by selecting the Recovery History

button.

The following screen will appear with a list of

the recoveries that have been made.

Highlight the record to be voided click the

Void button. The date, the reason for voiding the transaction, and a code

indicating the type of void are the only items that can be entered. To void the

recovery, simply save the record. If the bank (trust fund) was updated when the

original recovery was made, a message will appear to let you that the balance

has been adjusted.

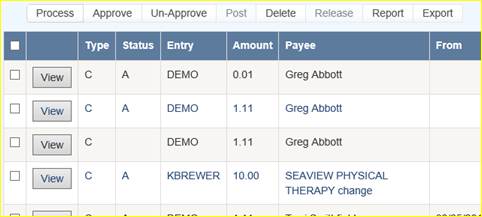

All payments that are entered with a status of

“B” are batched for future processing. At any time, these batched payments may

be reviewed, approved, posted, deleted and/or released (when pended) by anyone

with the proper access level.

Use the Process-Batched Payments menu and click

Process to view all the payments.

Use the Previous and Next buttons to page

through the list. The columns contain the following information.

|

Column |

Contents |

|

Type |

The

type of payment where C = check and V = voucher |

|

Status |

“A”

if the Approve feature is used, otherwise empty. |

|

Entry |

The

code for the user who entered the payment or AUTO if the system batched the

reoccurring payment. |

|

Amount |

The

amount of the payment |

|

Payee |

The

name of the payee |

|

From/Thru |

The

dates in the billing period |

|

Due |

The

date the payment is to be issued |

|

Desc |

The

pay code |

|

Transaction |

The

claim number followed by an asterisk and the number of the payment issued for

the claim |

|

Voucher |

The

number assigned

when the item

has been exported

with the Accounting Interface

module |

|

Entry

Date |

The

date the payment was batched |

The Edit Batch utility has a wide variety of

features as evidenced by the number of buttons and check/edit boxes that appear

on the form. Each of the features, including those available from the menu,

will be covered in the following sections.

There are two buttons that may be used to

process batched (the default) or pended payments which were entered for more

than the operator’s check writing limit.

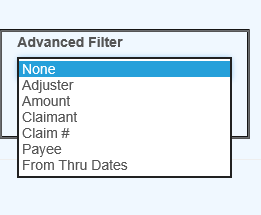

The following filters are available to select a

specific group of batched payments.

The ATS System has a Pre-Approve feature that

may be used to require the approval of payments before they can be printed.

If the Pre-Approve flag has been set using the

Module Parameters screen, these filters will be enabled so that all payments

that are not approved will be listed when the Process button is clicked. Remove

the check in the Not box to get a list of approved payments. (Approved payments

will have an "A" in the Status column.)

By default, all the payments that have not been

exported using the Accounting Interface will be listed. Remove the check in the

Not box to get a list of exported payments that have a number in the Voucher

column.

When the Region feature has been implemented,

this filter may be used to display a list of payments for claims in a specific

region. An operator may only view payments for a particular

region if one is specified in the operator's record and the Region View

is turned on.

By default, the payments for all the claims

that meet the other criteria (filters) will be listed. When this is a long

list, it may be difficult to find a payment for a specific claim. In that case,

click the Claims ellipsis button to display the Select Claim screen. Pick a

claim and only those payments will appear on the list.

The Payment program allows you to specify a Due

Date for each batched payment. By default, this field is empty so this filter

will have no effect.

Depending on the settings entered using the

Module Parameters screen, post-dating payments may be allowed. In that case,

the Due Date filter may be used to display payments with dates either on or

before the date specified (in the filter) or blank.

A variety of buttons are available so you can perform

the following functions.

If the Pre-Approve flag has been set to

"Y" using the Module Parameters screen, the Approve button will be enabled so batched payments can

be approved by an operator with the authority to print checks. Otherwise, this

button will be disabled (grayed out) since this step is not required. When this

feature is used, approved payments will have an "A" in the Status

column.

Any payment may be deleted from batch by an

operator with Delete permission. Simply highlight the desired item and click

the Delete button. The program will ask if you want to

perform the operation. To continue, click the Yes button.

The program will remove all references to the batched payment from the system

and adjust the reserves/paid amounts for the claim.

When a check has been made out by hand or

printed with a foreign system, an operator with Print Payments permission

should use the Post button to post the payment to the check

history table. The date and form number may be changed if necessary.

The next voucher number is found in the

client’s record, whereas check numbers are stored in the information for the

bank account.

Use Pend mode to view any payments that were

entered for an amount over the operator’s check writing limit. Select one of

the payments. If your check writing limit is higher than the amount of the

payment, the Release button will be available to place it in Batch

mode.

Use the View

button to view all of the information on a specific

payment. Notice the Browse button in the Payee group. Suppose that a

payment had issued to the wrong vendor. This button may be used to display the

Select Vendor dialog and pick the correct vendor without having to void the

payment and enter a new one. After making a change, click the Process button again to update the Payee name on the

list.

The Edit Batch Report

button may be used to produce a wide variety of reports with the currently

listed payments. Clicking the button will display the specification screen with

all of the default values as shown below. Check the

Page Eject box if you want a new page to be used when the value being sorted by

changes.

The report specifications are as follows:

|

Field |

Contents |

|

Sort

By |

Payments

may be sorted by Adjuster (the default), Claimant, Reserve Category/ Pay

Code, ATS Claim Number, Alternate Claim Number, or Region/Level 1. |

|

Mode |

Batched

or Pending payments. |

|

Checks |

A

check will display only checks on the report. |

|

Vouchers |

A

check will display only vouchers on the report. |

|

(Un)

Approves |

If

the Pre-Approve feature is used, a check will indicate which payments should

be included. |

|

(Not)

Exported |

A

check will either include the payments that have been exported (for printing)

or not. |

|

Claim

Number |

By

default, the wildcard % is used to include all claims. Click the ellipsis

button to select a particular one. |

|

Region |

By

default, payments for all regions will be included. |

|

Level

1 |

By

default, payments for all levels will be included. |

|

Page

Eject |

A

check will cause a page eject each time the Sort By

value changes. |

When you have finished entering the

specifications, click the Print

Preview button to

load the report into the ATS Print Previewer where it may be reviewed and/or

printed.

Each year, medical costs continue to skyrocket.

Instead of simply paying the full amount on every invoice, use the Medical Fee

module, an optional, add-on product designed to lower your medical costs. Each

line item on the invoice is calculated and either accepted or overridden based

on the state’s fee schedule, the DOL’s OWCP schedule, and/or the Usual and

Customary Reimbursement (UCR) value. A vendor’s custom fee schedule may also be

used.

This module has also automated the printing of

Explanation of Benefits to the medical providers. The UCR module is an optional

feature and not part of the standard ATS/Comp Medical Fee product.

Bundling and unbundling is another optional

feature that is available. The data to implement any of these features is

available from a third party.

1. By

default, the program will check to see if the specified vendor has an HMO/PPO

with Valid From/Thru dates that cover the From date in

the payment record. If so, it will look in the HMO/ PPO’s record for the rate

table to be used.

When a rate table is not specified (or found),

the program will use the vendor’s State to see if the Schedule flag for that

state has been set with the Maintain-State Codes menu.

If the vendor’s State field is empty or the

state has no fee schedule, a message will appear indicating that it will use

the Fee State Code set with the Administer-Configuration-Module Parameters menu

to calculate the amount for the line items to be paid on the invoice.

2. If

UCR percentiles are to be used, they should be stored by state with the Medical

Fee- UCR Percentile menu. By default, the program will detect that a percentile

exists for the vendor’s state and use the UCR value to calculate the amounts,

based on the zip code,

for the line items ignoring the $ per Unit value in the fee

schedule.

3. If

the Override State flag has been set with the Module Parameters menu, the

program will calculate the amount of the line item using both

of the above methods and display whichever amount is lower.

The bill review process is quick and easy. The Bill Review button will display a data entry screen with

two pages, the first of which is used to enter general information on the

payment as shown below.

|

Field Name |

Description |

|

Payment

Type |

The

type of payment, either check or voucher. |

|

Invoice |

The

number of the invoice that is being paid. |

|

Invoice

Date |

The

date of the invoice. |

|

Received |

The

date the department received the invoice may be entered for accounting

purposes |

|

Status |

The

status of the payment; either batch to be printed later, print when the

record is saved or notation only, which writes the payment record to the

check history file with a specified form number and processed date without

printing it first. |

|

Payment

Code |

The

code for the type of payment. |

|

Payment

Note |

A

note to be displayed on the check or voucher. |

|

Vendor

Code |

Enter

“C” if the payee is the claimant or press the Ellipsis button to select an

active vendor. |

|

Payee |

Making a selection will display the

name and address from the vendor’s record. |

Clicking the Line Items

button will display the page shown below.

The fields on this form are described as

follows:

|

Field Name |

Description |

|

Amount |

The

amount on the invoice. The total amount that will be paid for the line

item(s) is displayed in the Payable field. The program will display a message

and adjust the amount for the line item or the amount payable if either is

greater than the invoiced amount. |

|

Service

Zip |

By

default, the vendor’s zip will be displayed as the zip code where the service

was performed. This zip code will not only determine which fee schedule is

used, but also the tax rate if tax is to be applied as in New Mexico. |

|

ICD-9 |

The

ICD-9 code(s) from the invoice. Up to four codes may be entered. |

|

Inpatient |

A

check indicates that the employee has been admitted in a facility and treated

as an inpatient. |

|

Item |

The

number of the line item. Use the arrow keys to enter another item or review a

previous one listed in the grid below. |

|

From/Thru |

The

starting and ending date of the billing period. (The default ending date is

the same as the From Date.) These dates will determine which particular fee schedule to use. (It must be after the open

date on the claim.) For

your convenience, the previous From/Thru dates will

be displayed as you enter new line items. |

|

ICD-9 |

A

number to specify which ICD-9 code applies to the specified CPT code for the

line item. |

|

Invoiced

CPT Code |

The CPT

code for the item. Normally, this must be a valid code (in the fee schedule)

in order to continue. The exception is “00000”, which may be used to enter a

miscellaneous item that is not found in any fee schedule. Note

that the professional component or technical unit value may be used instead

of the maximum reimbursable by entering the CPT code followed by either

"-26" or “-27” respectively (e.g. 00100-26). |

|

CPT

Code |

If

the UCR module is in use, the vendor’s zip code will be used to determine the

appropriate region. |

|

Description |

The

description of the procedure. |

|

Modifiers |

Up

to three modifiers may be applied to the CPT code. For example, the following

modifiers may be applied to CPT 00100. |

|

Specialty |

When

there is a specialty associated with the CPT code, it may be selected from a

list of choices by clicking the Ellipsis button. |

|

Qty |

The

number of units billed for this line item. Unit Amount The amount billed per unit is optional. |

|

Amount |

The

amount billed for the procedure. If the amount per unit has been specified,

the program will multiply it by the quantity when the Qty is greater than one

and the CPT code begins with 1 or higher (anesthesia units are billed

differently). When

the following situation occurs, the invoiced amount will be set to zero. The

values from the preceding Invoiced fields will appear as soon as the Amount

is entered. |

|

Accepted

Amount |

The

Maximum Reimburseable Amount (MRA) is displayed if

it is less than the amount invoiced, otherwise the MRA will appear. As the

amount of each line item is accepted, the total value in the Payable field

will be incremented. Note

that if the Bundling/Unbundling feature is in use, the program will check for

major or comprehensive procedures that consist of a number

of individual procedures. For example, the CPT code 31505 (larynoscopy diagnostic) consists of many other

procedures, one of which is 36000 (microsurgery add-on). If both are on the

same bill, the program will detect that the "code 36000 is part of the

comprehensive procedure code 31505" and enter ZERO in the accepted

amount for line 36000. The program will also look for mutually exclusive procedures

(e.g. 27177 and 11010) that are not allowed on the same bill. |

|

Override |

An

override code to explain why the amount to be paid is different than the

amount billed. Press the Ellipsis button for the user-defined choices entered

with the Tables-Medical Fee menu. |

|

Futures |

The

amount available in the claim’s (future) medical reserves. See below for

details when the amount is insufficient to cover the payment. |

|

Payable |

As

line items

are entered and

accepted, the program

will adjust this

value accordingly. When the record is saved, this amount will be used

to update the paid to date and future reserves in the claim. |

|

Rate

Table |

The

program will display the name of the fee schedule table in use. |

If you are in the Override field and want to

enter another line item, press <Page Down> to increment the Line Number by one and move the cursor to the

next From field. By default, the previous From/ Thru

dates will be displayed for your convenience.

After all the line items have been entered,

save the record. The program will verify that the future medical reserves will

cover the payment. If the futures are not enough, the program will check the

Negative Reserves value set with the Module Parameters menu.

If the Negative Reserves value is

"Y", the entry is allowed and the future reserves in the claim will

become negative. If the value is "N", the program will check the

Stair Step Reserves value that was set using the Application Parameters screen.

If the Stair Step Reserves value is “A”, the

incurred amount in the claim will automatically be increased to cover the

payment. Otherwise, the Edit Reserves dialog may be used to increase the

reserves. (All changes depend on the operator's reserve limit.) Clicking Close without making a change will decrease the

amount to equal the future reserves.

At this point, the payment will be batched,

printed, or manually posted to history depending on how the Status field is

set.

Note that the payment will be pended if it is

over the operator’s check writing limit. (Pended payments must be released

using the File menu in the Batched Payments section of the Process module.)

After the record is saved, you will be asked if

you want to input another payment for this claim. If you click Yes, the form will be cleared so you can start

again. Otherwise, you will be returned to the main menu.

The Bundling and

Unbundling Feature

When this optional feature is in use, the

program will check for mutually exclusive procedures (e.g. 27177 and 11010)

that are not allowed on the same bill. It will also look for major or

comprehensive procedures that consist of a number of

individual components or procedures. For example, the CPT code 31505 (larynoscopy diagnostic) consists of many other procedures,

one of which is 36000 (microsurgery add-on). If both are on the same bill, the

program will detect that the "code 36000 is part of the comprehensive

procedure code 31505" and enter ZERO in the accepted amount for line 36000.

The ATS system supports multiple fee schedules;

federal (DOL), state, and the usual and customary reimbursement (UCR) schedule.

In that case, the program will display the amounts in the different schedules

so the user can make a selection.

Discounts and/or custom fee schedules can also

be setup for specific vendors. (Without this ability to use custom schedules,

invoices for vendors that use their own service codes could not be reviewed.)

After custom schedules have been setup, their use is transparent during data

entry unless the code on the invoice is found in multiple schedules.

If you would like to use this feature, please

contact ATS support as the procedure is beyond the scope of this manual.

Printing the

Explanation of Benefits

The Explanation of Benefits (EOB) is normally

printed at the same time as the payment. A special menu option is provided for

those clients who export their payments to be printed by a foreign system

and/or want to print them again later.

An option on the Financial menu may be used to

print the EOBs any time after the check or voucher payments have been printed

(not while they are still batched). When the report screen appears, enter the

specifications to meet your requirements.

|

Field Name |

Description |

|

Provider

Code |

A

specific provider (vendor) code. Leave this field empty to include every

provider that received a payment within the specified range of dates. |

|

Display

By |

The

EOBs will be sorted by provider code and then by either the claimant’s name

(the default) or the claim number. |

|

Starting

Date |

The

first payment date to be selected. By default, this is the date that was used

the last time the forms were produced. |

|

Ending

Date |

The

date of the last payments to be selected. |

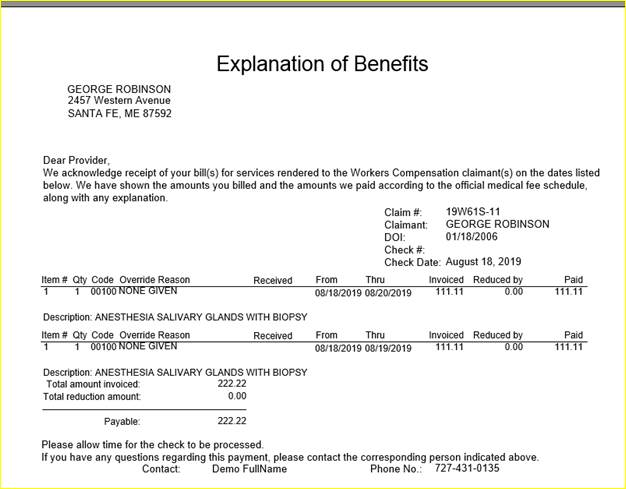

An example of the standard EOB has been

included below.

Figure 6‑3: Sample Explanation of Benefits

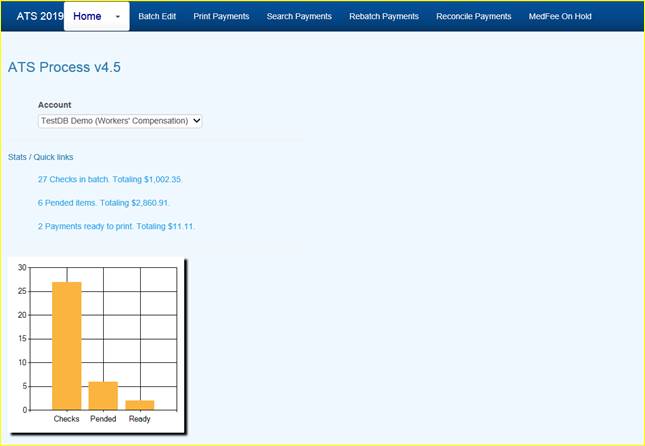

All payments that are entered with a status of

“B” are batched for future processing. At any time, these batched payments may

be reviewed, approved, posted, deleted and/or released (when pended) by anyone

with the proper access level.

Use the Batched Payments menu and click the Process button to view all the payments.

Use the Previous and

Next buttons to page through the list. The columns

contain the following information.

|

Column |

Contents |

|

Type |

The

type of payment where C = check and V = voucher |

|

Status |

“A”

if the Approve feature is used, otherwise empty. |

|

Entry |

The

code for the user who entered the payment or AUTO if the system batched the

reoccurring payment. |

|

Amount |

The

amount of the payment |

|

Payee |

The

name of the payee |

|

From/Thru |

The

dates in the billing period |

|

Due |

The

date the payment is to be issued |

|

Desc |

The

pay code |

|

Transaction |

The

claim number followed by an asterisk and the number of the payment issued for

the claim |

|

Voucher |

The

number assigned

when the item

has been exported

with the Accounting Interface

module |

|

Entry

Date |

The

date the payment was batched |

The Edit Batch utility has a wide variety of

features as evidenced by the number of buttons and check/edit boxes that appear

on the form. Each of the features, including those available from the menu,

will be covered in the following sections.

There are two buttons that may be used to

process batched (the default) or pended payments which were entered for more

than the operator’s check writing limit.

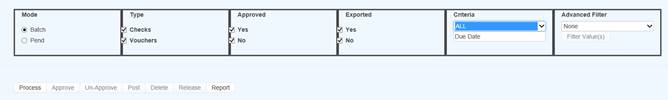

The following filters are available to select a

specific group of batched payments.

Figure 6‑5: Batch Mode Filters

The ATS System has a Pre-Approve feature that

may be used to require the approval of payments before they can be printed.

If the Pre-Approve flag has been set in Module

Parameters, these filters will be enabled so that all payments that are not

approved will be listed when the Process button is clicked. Remove the check in

the Not box to get a list of approved payments. (Approved payments will have an

"A" in the Status column.)

By default, all the payments that have not been

exported using the Accounting Interface will be listed. Remove the check in the

Not box to get a list of exported payments that have a number in the Voucher

column.

When the Region feature has been implemented,

this filter may be used to display a list of payments for claims in a specific

region. An operator may only view payments for a particular

region if one is specified in the operator's record and the Region View

is turned on.

Also available is the due-date filter.

By default, the payments for all the claims

that meet the other criteria (filters) will be listed. When this is a long

list, it may be difficult to find a payment for a specific claim. In that case,

click the Claims ellipsis button to display the Select Claim screen. Pick a

claim and only those payments will appear on the list.

![]()

A variety of buttons are available so you can

perform the following functions.

Approve/Un-Approve

If the Pre-Approve flag has been set to

"Y" with Module Parameters, these buttons will be enabled so batched

payments can be approved by an operator with the authority to print checks.

Otherwise, this button will be disabled (grayed out) since this step is not

required. When this feature is used, approved payments will have an

"A" in the Status column.

Any payment may be deleted from batch by an

operator with Delete permission. Simply highlight the desired item and click

the Delete button. The program will ask if you want to

perform the operation. To continue, click Yes. The

program will remove all references to the batched payment from the system and

adjust the reserves/paid amounts for the claim.

When a check has been made out by hand or

printed with a foreign system, an operator with Print Payments permission

should use the Post button to post the payment to the check

history table. The date and form number may be changed if necessary.

The next voucher number is found in the

client’s record, whereas check numbers are stored in the information for the

bank account.

Use Pend mode to view any payments that were

entered for an amount over the operator’s check writing limit. Select one of

the payments. If your check writing limit is higher than the amount of the

payment, the Release button will be available to place it in Batch

mode.

View

Button(s) on the grid

View

Button(s) on the grid

Use the View

button to view all of the information on a specific

payment. With proper authority information within the batched payment can be

modified.

The Report button may be used to produce a wide variety

of reports with the currently listed payments.

The Export button will export the grid to a Microsoft

Excel type format.

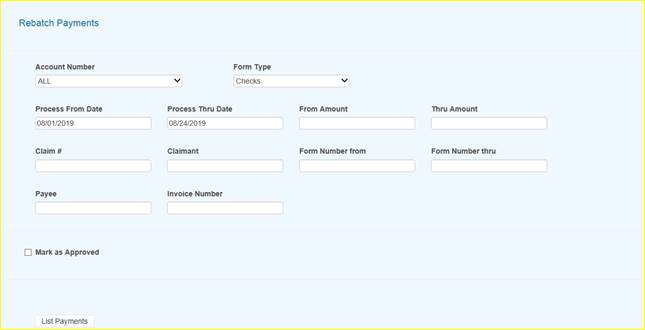

This feature is used to search printed items

that may need to be reprinted due to a print job error or a mistake on a check

or checks.

Figure 6‑9: Rebatch Payments Screen