Medical Fee Module

Each year, medical costs continue to skyrocket. Instead

of simply paying the full amount on every invoice, use the Medical Fee module, an optional, add-on product designed

to lower your medical costs. Each line item on the invoice is calculated and

either accepted or overridden based on the state’s fee schedule, the DOL’s OWCP

schedule, and/or the Usual and Customary Reimbursement (UCR) value. A vendor’s custom fee schedule may

also be used.

This module has also automated the printing of

Explanation of Benefits to the medical providers. The UCR module is an optional feature and not part of

the standard ATS/Comp Medical Fee product.

Bundling and unbundling is another optional feature

that is available. The data to implement any of these features is available

from a third party.

Setup Considerations

1. By

default, the program will check to see if the specified vendor has an HMO/PPO with Valid From/Thru dates that cover the From

date in the payment record. If so, it will look in the HMO/ PPO’s record

for the rate table to be used.

When a rate table is not specified (or found), the

program will use the vendor’s State to see if the

Schedule flag for that state has been set with the Maintain-State Codes menu.

If the vendor’s State field is empty or the

state has no fee schedule, a message will appear indicating that it will use

the Fee State Code set with the Administer-Configuration-Module Parameters menu

to calculate the amount for the line items to be paid on the invoice.

2. If UCR percentiles are to be used,

they should be stored by state with the Medical Fee- UCR Percentile menu. By

default, the program will detect that a percentile exists for the vendor’s state and use the UCR value

to calculate the amounts, based on the zip code, for the line items ignoring the $ per Unit

value in the fee schedule.

3. If the

Override State flag has been set with the Module Parameters menu, the program

will calculate the amount of the line item using both of the

above methods and display whichever amount is lower.

Making a Payment

The bill review process is quick and easy. The Bill

Review button will display a data entry screen with

two pages, the first of which is used to enter general information on the

payment as shown

below.

|

Field Name |

Description |

|

Payment

Type |

The

type of payment, either check or

voucher. |

|

Invoice |

The

number of the invoice that is being paid. |

|

Invoice

Date |

The

date of the invoice. |

|

Received |

The

date the department received the invoice may be entered for accounting

purposes |

|

Status |

The

status of the payment; either batch to be

printed later, print when the record is saved or notation only, which writes

the payment record to the check history file with a specified form number and

processed date without printing it first. |

|

Payment

Code |

The

code for the type of payment. |

|

Payment

Note |

A

note to be displayed on the check or voucher. |

|

Vendor

Code |

Enter

“C” if the payee is the claimant or press the Ellipsis button to select an

active vendor. |

|

Payee |

Making a selection will display the

name and address from the vendor’s record. |

Clicking

the Line Items button will display the page shown below.

The fields on this form are described as follows:

|

Field Name |

Description |

|

Amount |

The

amount on the invoice. The total amount that will be paid for the line

item(s) is displayed in the Payable field. The program will display a message

and adjust the amount for the line item or the amount payable if either is

greater than the invoiced amount. |

|

Service

Zip |

By

default, the vendor’s zip will be

displayed as the zip code where the service was performed. This zip code will

not only determine which fee schedule is used, but also the tax rate if tax

is to be applied as in New Mexico. |

|

ICD-9 |

The

ICD-9 code(s) from the invoice. Up to four codes

may be entered. |

|

Inpatient |

A

check indicates that the employee has been admitted in a facility and treated

as an inpatient. |

|

Item |

The

number of the line item. Use the arrow keys to enter another item or review a

previous one listed in the grid below. |

|

From/Thru |

The starting and ending date of the billing

period. (The default ending date is the same as the From Date.) These dates

will determine which particular fee schedule to use.

(It must be after the open date on the claim.) For

your convenience, the previous From/Thru dates will

be displayed as you enter new line items. |

|

ICD-9 |

A

number to specify which ICD-9 code applies to the specified CPT code for the line item. |

|

Invoiced

CPT Code |

The CPT code for the item. Normally, this must be a

valid code (in the fee schedule) in order to continue. The exception is

“00000”, which may be used to enter a miscellaneous item that is not found in

any fee schedule. Note

that the professional component or technical unit value may be used instead

of the maximum reimbursable by entering the CPT code followed by either "-26" or

“-27” respectively (e.g. 00100-26). |

|

CPT Code |

If

the UCR module is in use, the vendor’s zip code will be

used to determine the appropriate region. |

|

Description |

The

description of the procedure. |

|

Modifiers |

Up

to three modifiers may be applied to the CPT code. For example, the following modifiers may

be applied to CPT 00100. |

|

Specialty |

When

there is a specialty associated with the CPT code, it may be selected from a list of

choices by clicking the Ellipsis button. |

|

Qty |

The

number of units billed for this line item. Unit Amount The amount billed per unit is optional. |

|

Amount |

The amount billed for the procedure. If the

amount per unit has been specified, the program will multiply it by the

quantity when the Qty is greater than one and the CPT code begins with 1 or higher (anesthesia

units are billed differently). When

the following situation occurs, the invoiced amount will be set to zero. The values from the preceding Invoiced fields

will appear as soon as the Amount is entered. |

|

Accepted

Amount |

The Maximum Reimburseable

Amount (MRA) is displayed if it is less than the amount invoiced, otherwise

the MRA will appear. As the amount of each line item is accepted, the total

value in the Payable field will be incremented. Note

that if the Bundling/Unbundling feature is in use, the program will check

for major or comprehensive procedures that consist of a number of individual

procedures. For example, the CPT code 31505 (larynoscopy

diagnostic) consists of many other procedures, one of which is 36000

(microsurgery add-on). If both are on the same bill, the program will detect

that the "code 36000 is part of the comprehensive procedure code

31505" and enter ZERO in the accepted amount for line 36000. The program

will also look for mutually exclusive procedures (e.g. 27177 and 11010) that

are not allowed on the same bill. |

|

Override |

An

override code to explain why the amount to be paid is different than the

amount billed. Press the Ellipsis button for the user-defined choices entered

with the Tables-Medical Fee menu. |

|

Futures |

The

amount available in the claim’s (future) medical reserves. See below for

details when the amount is insufficient to cover the payment. |

|

Payable |

As

line items

are entered and

accepted, the program

will adjust this

value accordingly. When the record is saved, this amount will be used

to update the paid to date and future reserves in the claim. |

|

Rate

Table |

The

program will display the name of the fee schedule table in use. |

If

you are in the Override field and want to enter another line item, press

<Page Down> to increment the Line Number by

one and move the cursor to the next From field. By default, the previous From/ Thru dates will be displayed for your convenience.

Saving the Record

After all the line items have been entered, save the

record. The program will verify that the future medical reserves will cover the payment. If the futures are not

enough, the program will check the Negative Reserves value set with the Module Parameters menu.

If the Negative Reserves value is "Y", the entry is allowed

and the future reserves in the claim will become negative. If the

value is "N", the program will check the Stair Step Reserves value that was set using the Application

Parameters screen.

If the Stair Step Reserves value is “A”, the incurred amount in the claim

will automatically be increased to cover the payment. Otherwise, the Edit Reserves

dialog may be used to increase the reserves. (All changes depend on the

operator's reserve limit.) Clicking Close without

making a change will decrease the amount to equal the future reserves.

At this point, the payment will be batched, printed, or manually posted

to history depending on how the Status field is set.

Note that the payment will be pended if it is over the operator’s

check writing limit. (Pended payments must be released using the File menu in

the Batched Payments section of the Process module.)

After the record is saved, you will be asked if you

want to input another payment for this claim. If you click Yes,

the form will be cleared so you can start again. Otherwise, you will be

returned to the main menu.

The Bundling and

Unbundling Feature

When this optional feature is in use, the program

will check for mutually exclusive procedures (e.g. 27177 and 11010) that are

not allowed on the same bill. It will also look for major or comprehensive

procedures that consist of a number of individual components

or procedures. For example, the CPT code 31505 (larynoscopy

diagnostic) consists of many other procedures, one of which is 36000

(microsurgery add-on). If both are on the same bill, the program will detect

that the "code 36000 is part of the comprehensive procedure code

31505" and enter ZERO in the accepted amount for line 36000.

Using Custom Fee Schedules

The ATS system supports multiple fee schedules; federal (DOL), state, and

the usual and customary reimbursement (UCR) schedule. In that case, the

program will display the amounts in the different schedules so the user can make a selection.

Discounts and/or custom fee

schedules can also be setup for specific vendors.

(Without this ability to use custom schedules, invoices for vendors that use

their own service codes could not be reviewed.) After custom schedules have

been setup, their use is transparent during data entry unless the code on the

invoice is found in multiple schedules.

If you would like to use this feature, please contact

ATS support as the procedure is beyond the scope of this manual.

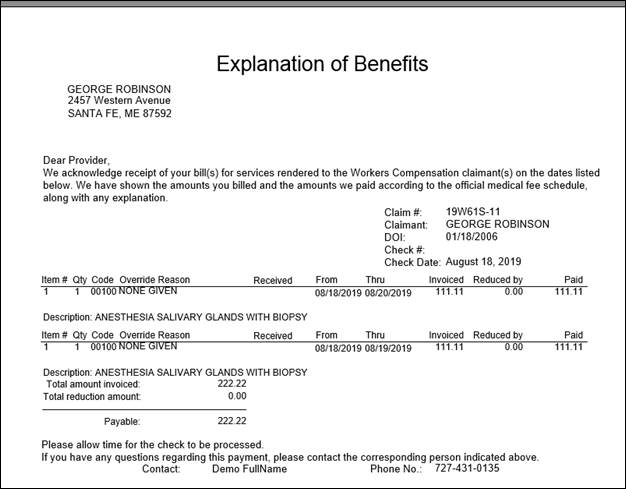

Printing the Explanation of Benefits

The Explanation of Benefits (EOB) is normally printed at the

same time as the payment. A special menu option is

provided for those clients who export their payments to be printed by a foreign

system and/or want to print them again later.

An option on the Financial menu may be used to print

the EOBs any time after the check or voucher payments have been printed (not

while they are still batched). When the report screen appears, enter the

specifications to meet your requirements.

|

Field Name |

Description |

|

Provider

Code |

A

specific provider (vendor) code. Leave this

field empty to include every provider that received a payment within the specified range of dates. |

|

Display

By |

The

EOBs will be sorted by provider code and then by either the claimant’s name

(the default) or the claim number. |

|

Starting

Date |

The

first payment date to be selected. By default, this is the

date that was used the last time the forms were produced. |

|

Ending

Date |

The

date of the last payments to be selected. |

An

example of the standard EOB has been included below.

Figure

6‑3: Sample Explanation of Benefits