Vendors

Any individual or company that provides a service associated with a claim is considered a vendor in the ATS system. If you use some other software package that tracks vendors, your system may be customized to import the relevant data to save time and ensure accuracy.

Entering a New Vendor Record

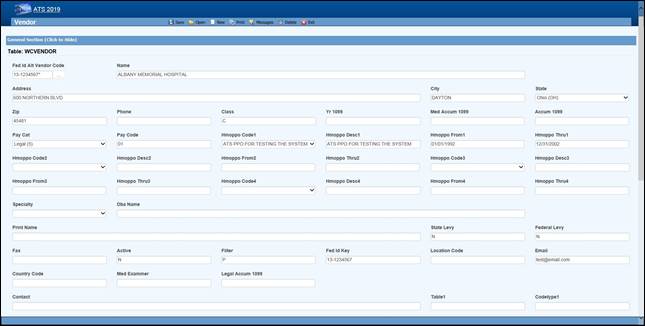

Operators with the appropriate access rights may use the Vendor tab to enter a new record. The first of the two sections is shown below.

Figure 3‑1: Vendor Page - General Section

Figure 3‑1: Vendor Page - General Section

The first section (General) contains general information on the vendor. The fields are described as follows:

|

Field Name |

Description |

|

Tax

ID |

Although any code may be entered for tracking

purposes, a valid federal ID or social security number must be entered if a

1099 will be filed. The

ATS system often refers to a vendor code which is the tax ID, an asterisk, and

the location code if any. In the example above, the vendor code is

77-7878787* since the location code is blank. |

|

Location Code |

A code should be entered when a vendor has multiple locations that use the same tax

ID. For example, a medical clinic with several offices may have one tax ID

and a unique location code for each office. When looking up an existing record, enter the

tax ID into the Vendor Selection dialog and all of

the locations with that number will be listed. Note:

This field is also referred to as the Alternate Vendor Code. |

|

Search Name |

The

name to be used for lookup purposes. If the vendor is an individual such as John Brown, we

recommend entering a Search Name as “Brown, John” so that the record is

easier to find. In that case, the person’s real name should be specified as

the Print Name to be displayed on a check or voucher. |

|

Address |

The

complete mailing address. A second line may be used

if necessary. |

|

City |

The

vendor’s city. |

|

State |

The

vendor’s state code. |

|

Zip |

The

zip or postal code. |

|

District |

The

district or region where the vendor is located. |

|

Country |

The

code for the country where the vendor is located if outside the US. |

|

Phone Fax |

The

vendor’s phone and fax

numbers. Enter 10 digits such as

4101234567 and the program will display 1+ (410) 123-4567 for a US number. |

|

E-mail |

The

vendor’s e-mail address. |

|

Contacts |

The

name of a contact person or two. |

|

Active |

A check indicates that the vendor is active. If the box is unchecked, the

Payment program will not allow payments to be issued to the vendor. Since

vendor records are normally kept in the system for

historical purposes, we recommend that you use this feature to indicate that

the vendor is inactive instead of deleting the vendor’s record. |

|

Reason |

The

reason why the vendor is considered inactive may be entered when

needed. |

|

Rsv Category Pay

Code |

The

default reserve category and pay code to use when making payments to the

vendor. For example, if the

vendor is a hospital, enter “2” or Medical as the reserve category and the

appropriate pay code. The fields will be automatically filled in when making

payments to the hospital. |

|

Filter |

The

Claims program will use this code to generate the

lists that appear when selecting vendors. If an “A” (attorney) is entered,

the vendor will only appear when selecting a legal firm

for the claimant or defense. When an

“P” is entered, the vendor will only be listed as a medical or rehab

provider. |

|

NPI |

The

National Provider Identifier assigned to medical care providers. |

|

Biller ID |

A

code or number assigned to the vendor by the accounting department. |

|

DBA Name |

The

“doing business as” name should be entered for vendors classified as

individuals for 1099 reporting purposes. |

|

Print Name |

The

name to be printed on payments made to this vendor. If this field is

empty, the Search Name will be used. |

|

State/Federal

Levy |

Check

the box if the Payment program should display a message indicating that the

vendor has a state or federal lien. |

|

Specialty |

Press

the Ellipsis button to select from a list of available codes. |

|

Examiner # |

The

medical examiner number required in certain states such as Florida. |

|

Work Status |

A

special field used in the PERI Interface. If this data is required by the

PERI Data Exchange, press the Ellipsis button to select from a list of

available codes. |

|

Direct Deposit |

Check

this box if the vendor is to receive payments electronically. |

|

Routing Number |

The

routing number for the vendor’s bank. |

|

Bank Account |

The

vendor’s bank account

number. |

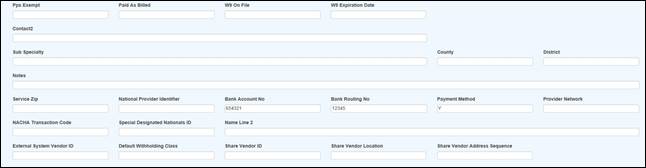

The second screen contains the information needed to produce the 1099-MISC returns. The rest of the fields are used in the optional Medical Fee - Bill Review module.

Figure 3‑2: Vendor Page - Finance Section

Figure 3‑2: Vendor Page - Finance Section

The fields in the Finance section of the page are described as follows:

|

Field Name |

Description |

|

W-9 on File |

Check

this box if the W-9 is on file. |

|

W-9 Expiration |

The

date the current W-9 expires. |

|

Class |

Exempt

indicates that the vendor should not receive a 1099. If you file your

1099s electronically, enter Individual if the vendor's tax ID is a social

security number, otherwise it will be reported as a federal ID. In either

case, the program will strip out all dashes and report a nine

digit number. |

|

Primary

Vendor |

If

there is more than one vendor with the same tax ID but different location

codes, use this field to indicate the Primary Vendor that should get the 1099. |

|

Name

Control |

Filing

Electronically: The name control should be the first four significant letters

of the name excluding spaces and titles such as Mr. and Dr. |

|

2nd

TIN Notice |

A

check indicates that you have received two notices within three years stating

that the vendor's tax ID is

incorrect. The 1099 program will also check this box on the form

so the IRS will not send any further notices regarding this vendor. |

|

Special

Data |

Filing

Electronically: This field may be used to enter special data to be included

when using the 1099 Combined Federal/State Filing program. |

|

1099 Year |

The

1099 Accumulation program will enter the year to

be reported. |

|

1099 Other 1099 Legal 1099 Med 1099 Misc |

The 1099 Accumulation program will update the 1099

Other (Income), Legal, Medical and Misc

(Non-employee Comp) fields with the payments for pay codes

that have 3, C, 6, or 7 as the 1099 Type value. Refer

to the 1099 Reporting Information below to find out

which record gets updated when there is more than one vendor with the same tax ID. |

|

Service

Zip |

The

zip code where the vendor provides service. |

|

HMO/PPO Info |

Press

the Ellipsis button for a list of valid HMO/PPO providers. Selecting a code will

automatically display the description and the range of dates when valid. Up

to four may be used when making payments to the vendor with the Medical Fee module. The program will check to see if

there is an HMO/PPO that covers the From Date in the payment record. If so, the program will use the

alternate rate table for the HMO/PPO when reviewing the billed items. |

|

Facility |

The

type of facility when it affects the repricing of medical bills. |

|

Vendor Type |

The

type of vendor to use for DOH filing purposes. |

|

PPS Exempt |

Check

this box if the vendor is exempt from PPS. |

|

Paid

as Billed |

Check

this box if medical bills should NOT be reduced for some reason (e.g. the

vendor is under the Maryland Health Services Cost

Review Commission). |

|

Notes |

Any

notes regarding the vendor. |

1099 Reporting

A medical clinic with several offices may use one tax ID and a unique location code for each office. When the 1099 Accumulation program is launched with the Combine Vendor option, the first record for the vendor is normally used by default. In this example, the one with the blank Location would be considered the primary vendor to receive the 1099. (When sorted, numbers come before letters.)

|

Tax ID |

Location |

1099 |

|

94-1234567 |

|

YES |

|

94-1234567 |

110A |

NO |

|

94-1234567 |

ABC |

NO |

If the primary vendor is not the first record, check the Primary Vendor box so it will be updated by the 1099 Accumulation program.

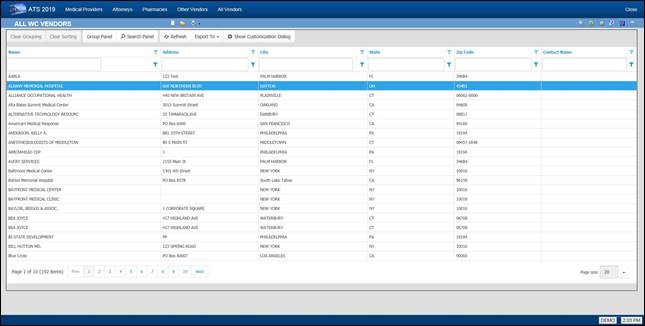

Editing an Existing Record

The Vendor menu provides a number of standard options that will return pre-defined results lists based on the value of the Filter field on the Vendor record or some other criteria.

· Medical Providers (Vendors with a Filter = “P”)

· Attorneys (Vendors with a Filter = “A”)

· Pharmacies (Vendors with a Filter = “R”)

· Other Vendors (Vendors with a Filter = “O”)

· All Vendors (Vendors on claims where the current user is the adjuster)

Optionally, Selected Vendors can be used to locate the record you want to view and/or modify. The Selected Vendors page displays a number of fields for input of search criteria that will be used to find matching records. By default the system looks for active vendors. If you need inactive vendors, change the active filter in the list to “NO”.

Note that the following example uses the standard result list. The one on your system may be different. The search and filter features on the results list page can be used to further narrow down the results.

Figure 3‑3: Vendor Result List

Figure 3‑3: Vendor Result List

If the Tax ID or Location is changed, every payment made to the vendor will be updated for (1099) reporting purposes, even those that are still in batch. Any batched payment will also be updated when the address is modified. In that case, the historical payments will not be changed.